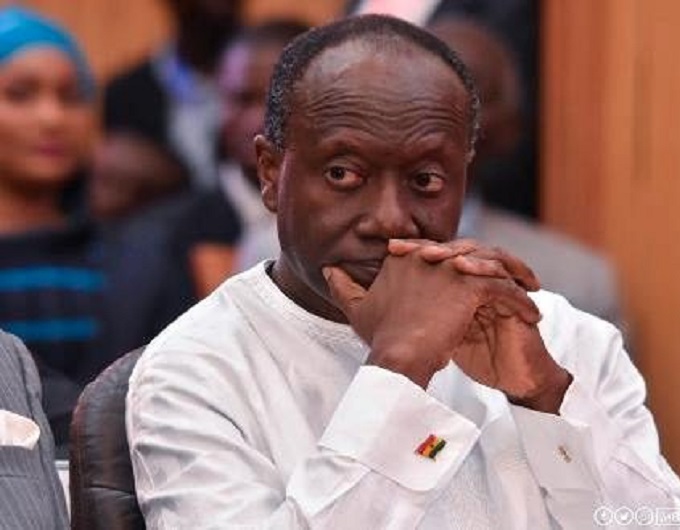

Finance Minister, Ken Ofori Atta has revealed that government has so far injected about 8billion bailout into the banking sector to protect the funds of depositors.

According to him, reports on the collapse of Banks have revealed a lot of abuse on the part of some shareholders of these banks, hence the move by the government to protect the interest of depositors and as well, reduce job losses.

"Since January 2017, we have been confronted with information on the industry that reflects the systemic abuse and historic ineptitude in protecting the industry that is at the heart of our people. We have spent about 8billion to ensure depositors and investors don't lose their money, and to reduce job losses." Mr Ofori Atta added.

Read Also:Â ADB & NIB will surely merge - Finance Minister

Speaking at the forum held at the Danquah Institute under the theme, "THE BANKING SECTOR CLEAN UP – ARE DEPOSITORS SAFE?" the Finance Minister explained, the government has also had to deal with some legacy debts, all in a bid to protect the interest of depositors.

"A review done by the Bank of Ghana in 2017, set the tone for what is to confront the government when more than nine banks were found to be problematic and mostly on the lifeline, emergency liquidity support, etc, we also had issues with some legacy debts that we had to resolve,"

He added the banking crisis is as a result of plain thievery on the part of some bank directors and shareholders.

"The heart of the matter is that it is plain thievery on citizens by certain shareholders and directors and also with a clear comprise on the regulatory leader on a scale that has not happened before in our country's history.

Meanwhile, Dr Osei Assibey Antwi, a Senior Research Fellow at the Institute of Economic Affairs (IEA), has indicated that signs of the of the collapse of banks were evident since the year 2012.

Read Also:Â Signs of