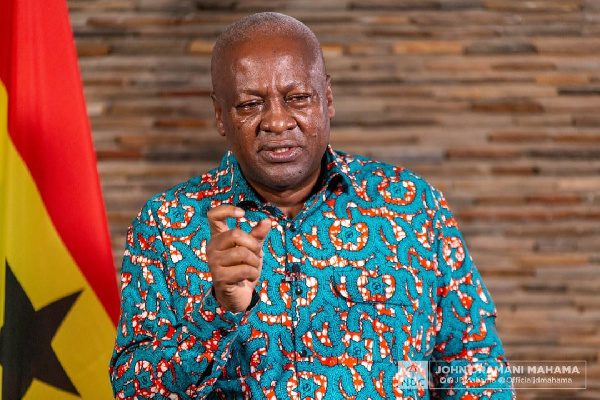

Former President John Dramani Mahama says there are no credible remedial plans by the government to salvage the economy.

John Mahama's statement is in reaction to the downgrade of Ghana’s economy by S&P credit rating agency.

In a Facebook post, Mr Mahama said: "There appears to be no end to the problems with the Ghanaian economy, with the recent downgrade to CCC+/C Junk status."

"The steep depreciation of the Ghana Cedi in recent days, clearly shows that the mid year review of the 2022 budget failed to win back the confidence of the investor community and the Ghanaian public."

"Unfortunately, no credible remedial plans have been put forward by the government to salvage the economy."

READ ALSO : S&P downgrade: Ghana is in a bad situation- Dr. John Kwakye

"A national dialogue on the economy, bringing some of our best brains together will serve us well, even as we prepare for debt restructuring and negotiation of an IMF programme."

S&P Global Ratings

S&P Global Ratings said though government has taken steps towards consolidating the fiscal deficit, including the recent passage of the Exemptions bill, high borrowing costs and softening growth make it difficult to put debt to GDP on a downward path.

After a careful assessment of the economy, S&P also reviewed the country’s economic outlook as negative. The negative outlook, in a statement issued by S&P on Friday, August 5, 2022, reflects Ghana’s limited commercial financing options, and constrained external and fiscal buffers.”

S&P Global Ratings also noted that the Covid-19 pandemic and the Russian invasion of Ukraine had worsened Ghana’s fiscal and external imbalances.

Demand for foreign currency has been driven higher by various factors, including non-resident outflows from domestic government bond markets, a lack of access to Eurobond markets, retail dollar purchases, dividend payments to foreign investors, and higher costs for refined petroleum products.

Currently, the local currency which has seen a sharp depreciation in recent times is nearing ¢9 to one US dollar.

It would be recalled that government earlier this year introduced some revenue generation measures such as the E-Levy, the Tax Exemptions Bill, and some cuts in discretionary spending.

However, S&P notes that while these changes could improve revenue generation going forward, the situation remains challenging.