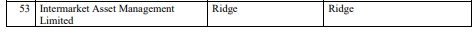

The Securities and Exchange Commission (SEC) will begin accepting relevant documents for the validation of investment claims on November 18, 2019, following the revocation of the licences of 53 Fund Management Companies.

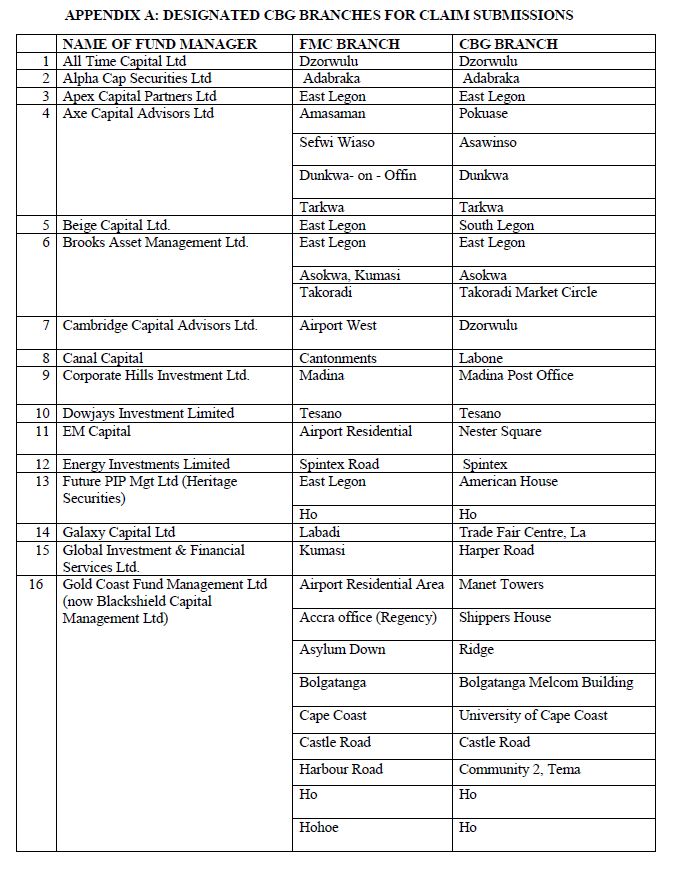

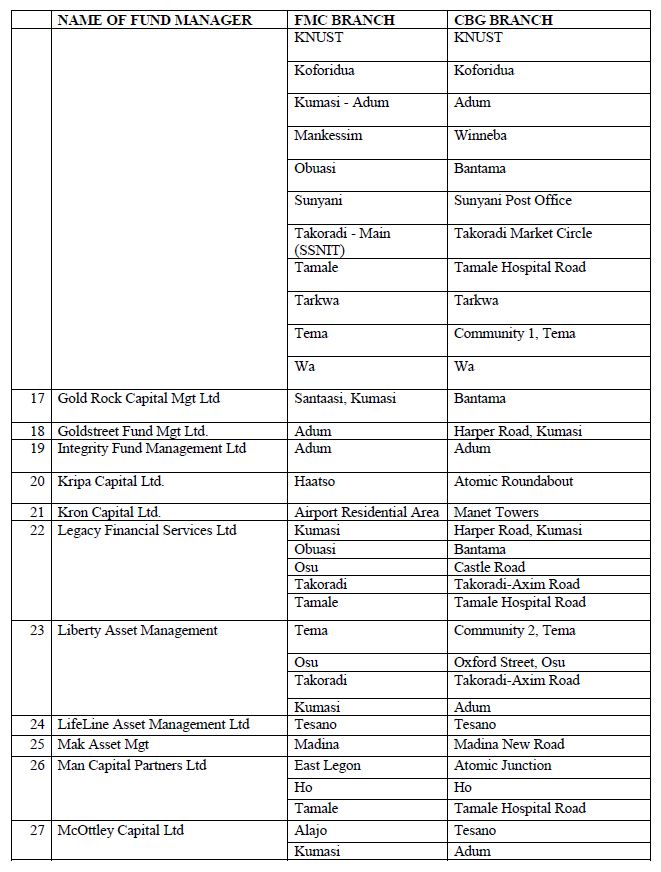

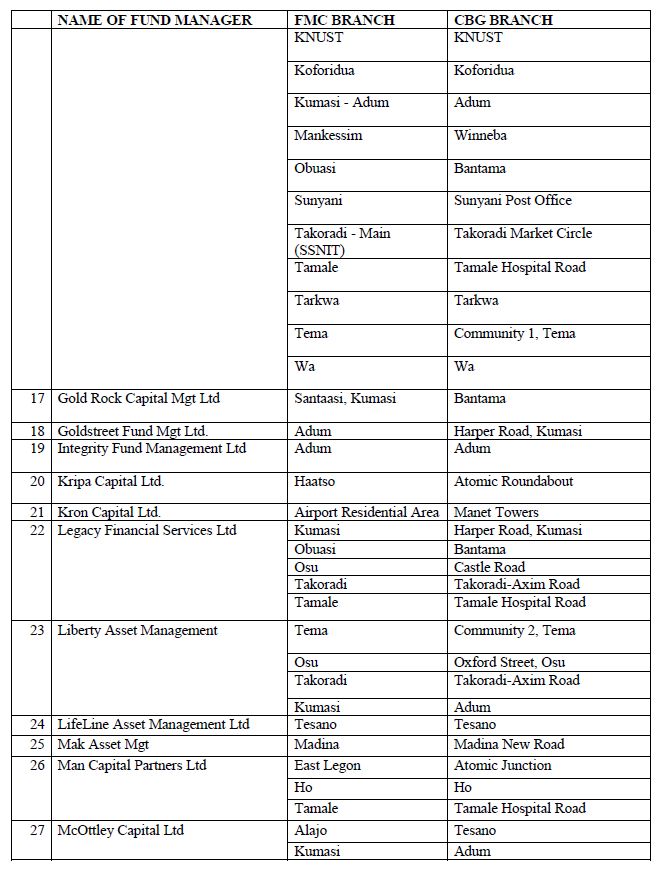

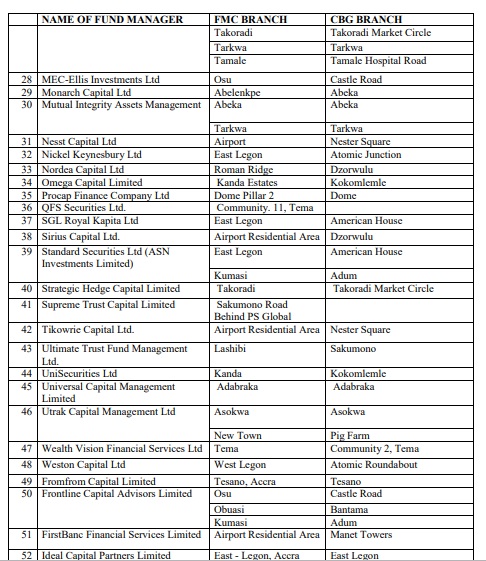

In a statement, the SEC said designated branches of Consolidated Bank of Ghana Limited (CBG) will open to receive the claims from clients who have their funds locked up at the affected companies.

The SEC said it has authorised the said branches serving as agents “to ascertain and validate details of investors and their investments with these institutions at the time of the revocation to facilitate the administration of the Government pay-out of a capped amount to affected investors.â€

READ ALSO : Collapsed Fund Management companies : Liquidation could be completed within a year - Registrar General

The agent is also to support in “the closing down, securing the premises and records of these [collapsed] institutions.â€

The SEC is expecting evidence of investment claims such as investment certificates, account statements, receipts among other relevant documentation for validation.

“Investors are advised to visit the designated CBG branches assigned to the affected FMCs for repayment of investments made and any other enquiries relating to the revocation of their affected FMCs.â€

Government has provided about 1.5 billion Cedis as partial support for clients of 53 collapsed fund management companies.

An accounting firm, Price Waterhouse coopers which has been appointed by the Registrar General is expected to act as the receiver to help validate claims from the investors.

After the validation, the receiver will then commence part payment of clients of these firms.

Each investor will be paid 20,000 Ghana Cedis and the rest of their investments will be paid later based on what the liquidator secured from the assets of the firms.

SEC after the revocation of the licences disclosed that about ¢8b investments of 81,700 clients, made up of 44,000 institutional customers and 7,700 retail customers are involved.