The term A Ponzi scheme has become popular in the wake of the Menzgold saga.

Some beleive the activities of the embattled gold dealership firm can be linked directly with Ponzi schemes.

What is a Ponzi Scheme?

A Ponzi scheme is a form of fraud which lures investors and pays profits to earlier investors by using funds obtained from more recent investors. The victims are led to believe that the profits are coming from product sales or other means, and they remain unaware that other investors are the source of profits.

A Ponzi scheme is able to maintain the illusion of a sustainable business as long as there continue to be new investors willing to contribute new funds, and as long as most of the investors do not demand full repayment and are willing to believe in the non-existent assets that they are purported to own.

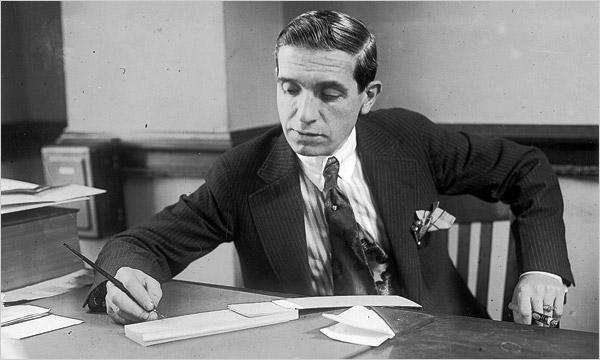

The scheme is named after Charles Ponzi who became notorious for using the technique in the 1920s.The idea had already been carried out by Sarah Howe in Boston in the 1880s through the "Ladies Deposit".

Howe offered a solely female clientele an eight-percent monthly interest rate, and then stole the money that the women had invested. She was eventually discovered and served three years in prison.

The Ponzi scheme was also previously described in novels; Charles Dickens' 1844 novel Martin Chuzzlewit and his 1857 novel Little Dorrit both feature such a scheme.Ponzi carried out this scheme and became well known throughout the United States because of the huge amount of money that he took in.

His original scheme was based on the legitimate arbitrage of international reply coupons for postage stamps, but he soon began diverting new investors' money to make payments to earlier investors and to himself.

Who is Charles Ponzi?

Charles Ponzi, (born Carlo Pietro Giovanni Guglielmo Tebaldo Ponzi; March 3, 1882 – January 18, 1949), was an Italian swindler and con artist in the U.S. and Canada. His aliases include Charles Ponci, Carlo, and Charles P. Bianchi. Born and raised in Italy, he became known in the early 1920s as a swindler in North America for his money-making scheme.

He promised clients a 50% profit within 45 days, or 100% profit within 90 days, by buying discounted postal reply coupons in other countries and redeeming them at face value in the United States as a form of arbitrage.

In reality, Ponzi was paying earlier investors using the investments of later investors. While this type of fraudulent investment scheme was not originally invented by Ponzi, it became so identified with him that it now is referred to as a "Ponzi scheme".

His scheme ran for over a year before it collapsed, costing his "investors" $20 million.

Ponzi may have been inspired by the scheme of William F. Miller, a Brooklyn bookkeeper who in 1899 used the same scheme to take in $1 million.

Characteristics of a Ponzi Scheme

Typically, Ponzi schemes require an initial investment and promise above average returns.

They use vague verbal guises such as "hedge futures trading", "high-yield investment programs", or "offshore investment" to describe their income strategy.

It is common for the operator to take advantage of a lack of investor knowledge or competence, or sometimes claim to use a proprietary, secret investment strategy in order to avoid giving information about the scheme.

The basic premise of a Ponzi scheme is "To rob Peter to pay Paul". Initially, the operator will pay high returns to attract investors and entice current investors to invest more money. When other investors begin to participate, a cascade effect begins. The "return" to the initial investors is paid by the investments of new participants, rather than from profits of the product.

Often, high returns encourage investors to leave their money in the scheme, so that the operator does not actually have to pay very much to investors.

The operator will simply send statements showing how much they have earned, which maintains the deception that the scheme is an investment with high returns. Investors within a Ponzi scheme may even face difficulties when trying to get their money out of the investment.

Operators also try to minimize withdrawals by offering new plans to investors where money cannot be withdrawn for a certain period of time in exchange for higher returns. The operator sees new cash flows as investors cannot transfer money. If a few investors do wish to withdraw their money in accordance with the terms allowed, their requests are usually promptly processed, which gives the illusion to all other investors that the fund is solvent and financially sound.

Ponzi schemes sometimes begin as legitimate investment vehicles, such as hedge funds that can easily degenerate into a Ponzi-type scheme if they unexpectedly lose money or fail to legitimately earn the returns expected. The operators fabricate false returns or produce fraudulent audit reports instead of admitting their failure to meet expectations, and the operation is then considered a Ponzi scheme.

A wide variety of investment vehicles and strategies, typically legitimate, have become the basis of Ponzi schemes. For instance, Allen Stanford used bank certificates of deposit to defraud tens of thousands of people. Certificates of deposit are usually low-risk and insured instruments, but the Stanford CDs were fraudulent.

Red flags

According to the United States Securities and Exchange Commission (SEC), many Ponzi schemes share similar characteristics that should be "red flags" for investors.

The warnings signs include:

1. High investment returns with little or no risk. Every investment carries some degree of risk, and investments yielding higher returns typically involve more risk. Be highly suspicious of any "guaranteed" investment opportunity.

2. Overly consistent returns. Investment values tend to go up and down over time, especially those offering potentially high returns. Be suspicious of an investment that continues to generate regular positive returns regardless of overall market conditions.

3. Unregistered investments. Ponzi schemes typically involve investments that have not been registered with the SEC or with state regulators. Registration is important because it provides investors with access to key information about the company's management, products, services, and finances.

4. Unlicensed sellers. Federal and state securities laws require investment professionals and their firms to be licensed or registered. Most Ponzi schemes involve unlicensed individuals or unregistered firms.

5. Secretive or complex strategies. Avoid investments that you do not understand or for which you cannot get complete information.

6. Issues with paperwork. Do not accept excuses regarding why you cannot review information in writing about an investment. Also, account statement errors and inconsistencies may be signs that funds are not being invested as promised.

7. Difficulty receiving payments. Be suspicious if you do not receive a payment or have difficulty cashing out your investment. Keep in mind that Ponzi scheme promoters routinely encourage participants to "roll over" investments and sometimes promise even higher returns on the amount rolled over. At times, Ponzi scheme promoters offer returns whenever a customer requests to pull out of the investment, creating an illusion of the investment being profitable.

Read also: Profile of MenzGold CEO, Nana Appiah Mensah

Ghana News: Latest news in Ghana

Â