Amid capital flight from the stock market – induced by the increasing interest rate on the fixed income market, the Ghana Stock Exchange (GSE) is expected to continue on its current downward trajectory in the third quarter, SEM Capital has said.

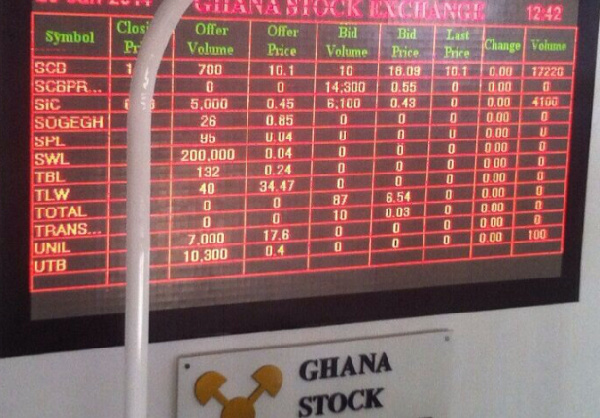

The GSE’s benchmark Composite Index (GSE-CI) closed the second quarter of 2022 falling 8.74 percent, while its Financial Stock Index (GSE-FSI) has appreciated by 1.17 percent during the period under consideration.

This represents a turnaround from 36.40 percent for the former and 6.05 percent for the latter at the end of June 2021.

“Interest rates are expected to inch upward – largely fuelled by inflationary pressures and for government to meet its financing needs through domestic issuances.

“On the capital market, the return on the GSE Composite Index is likely to be bearish as a result of capital flight to the fixed income market due to rising interest rates,” SEM Capital noted in its Second Quarter 2022 Market Report.

The Financial Index performed better than the broad market primarily due to major price recoveries in key listed financial stocks – SIC Insurance, Ecobank and Trust Bank Gambia.

Winners and Losers

During the quarter, SIC was the top gainer with a quarterly return of 40.91 percent, closing the quarter at GH¢0.31.

“The rally was mainly due to investor confidence in the firm’s 2021 financial performance,” SEM noted.

The second gainer for the quarter was Access Bank, which had a quarterly return of 20.10 percent; and TBL which ended the quarter at GH¢0.44, representing a 10 percent quarterly gain.

On the flip side, energy stock Total led the pack of six losers, ending the quarter at GH¢.10 and representing a quarterly loss of 18.33 percent, followed by MTN. The other Top-5 losers were in the finance and energy segments. They are Cal Bank, GCB Bank, Société Générale and Goil, which lost 6.98 percent, 3.10 percent, 0.84 percent and 0.55 percent, respectively. During the quarter, prices of more than half of the listed stocks, 19, remained flat.

MTN

The market has also been hit as its most traded stock – MTN, which was responsible for 96.11 percent and 94.85 percent of the volume and value of shares traded in the first two quarters – has seen its share price plummet by 18.92 percent from turn of the year to end of June, closing the period at GH¢0.9.

Analysts suggest that a number of factors including, but not limited to, the aforementioned capital flight due to improved fixed income rates; the possible impact of recent initiatives such as the E-levy and the GhanaPay portal as well as impact of the earnings season, are responsible for the market-driving stock’s performance.

BFT