With the on-going implementation of the one-district-one factory project by the President Nana Akufo-Addo led administration, existing and start-up firms in Ghana are in a desperate need for financing of new products or expansion initiatives.

Perhaps the last resort for these businesses after exhausting the options of partners, venture capitalist, personal funds, among others is usually the banking and non-banking financial institutions for loans.

There is however one major deterrent to this option: while most credit facilities offered by banks do not require excessive equilateral for their security, the average business owner in Accra will tell you, “the bank interest rates are too high we can’t afford itâ€.

There is also the public servant or private sector professional who would love to take a mortgage, car or even an education loan for a dependent's tuition but also drops the idea for similar reasons.

Now from a 27.6% as at January 2017, with the trend breaking slightly in April which recorded a 0.1% higher rate than March’s 26.7 %: Bank of Ghana reports for May 31st has the base Average Interest Rate for banks and non-banking financial institutions standing at 26.6% indicating an approximately 0.7% decline from the preceding month.

The new drop in the BoG’s base APR for May also consolidates for April which witnessed the only increase within a four months period.

If the central bank’s APR continues to fall at least on a 0.1 – 0.2% monthly, there is no doubt that by end of the year the cost of borrowing would likely be around 25% and the demand for credit across the country would have grown drastically.

However, there are some issues to address in sustaining this declined cost of borrowing in the economy: paramount among which is inflation (of both the Ghana cedi as well as commodities).

There is also the challenge of compliance on the part of the banks with the central bank’s base APR.

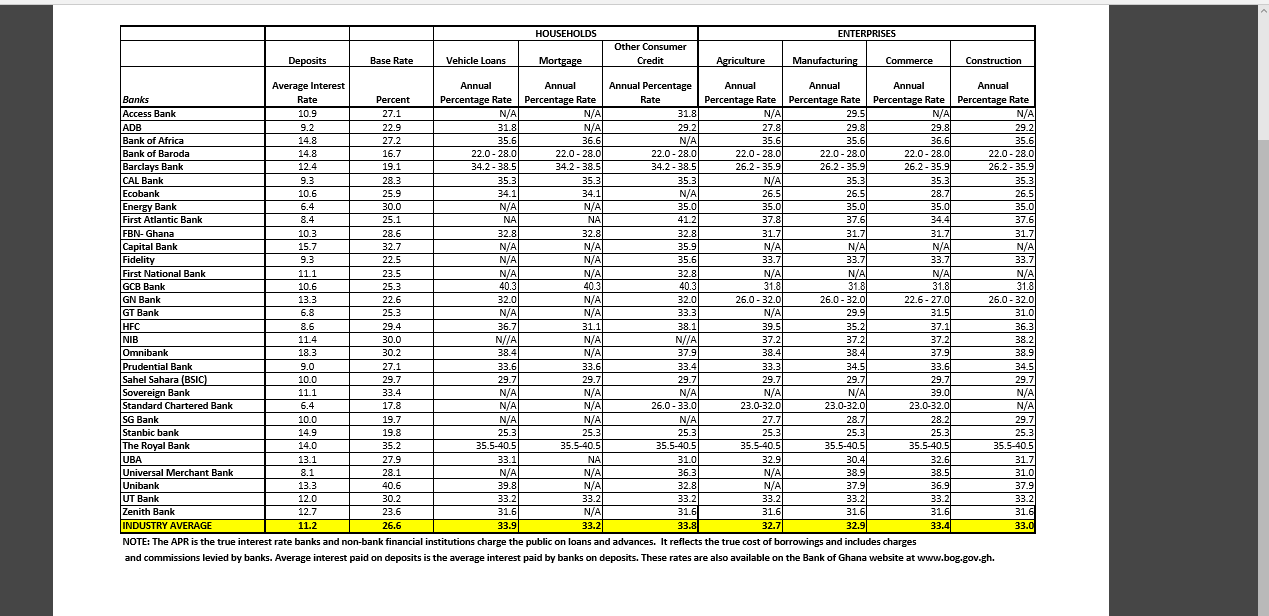

For instance, while the May Bank of Ghana base APR stands at 26.6%, below are actual cost of borrowing across the major banking financial institutions in the country:

Hence for a sustained declined, at least a balanced one that naturally results from a stable macroeconomic environment, there must be proper monitoring of both the banks in the urban areas or cities as well as those in the rural communities across the country to ensure that while taking into account the risk involved in the issuance of loans to individual customers, there is an even level of compliance to the Bank of Ghana base Average Interest Rate.

Â