The average ex-pump price for petroleum products in the country fell below estimates by the National Petroleum Authority (NPA) by the end of August by 10.8%. Â

The disclosure was contained in the August 2017 edition of the Brief on Petroleum Product Price Increase by the NPA. Â

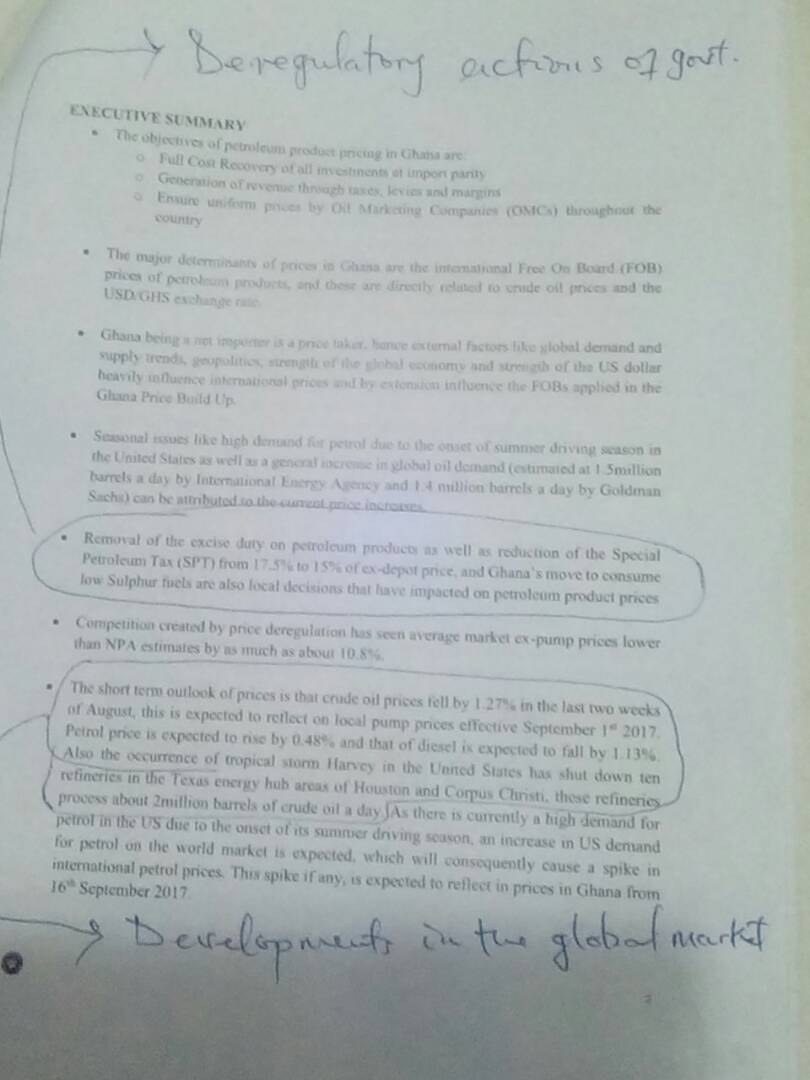

According to the brief made available to PrimeBusiness, the fall was due to measures by the government to deregulate the petroleum sector. These included removal of the exercise duty on petroleum products, reduction of the Special Petroleum Tax (SPT) from 17.5 – 15% as well as the move to consume low Sulphur fuels: all of which increased the level of participation by local private players and resulted in higher level competition in the industry, with effect being a reduction pump prices.

The document also revealed that in the short-term outlook, crude oil prices fell by 1.27% during the last two weeks of August with pump price of petrol increasing by 0.48%, while that of diesel reduced by 1.13% as of 1st September this year.

In addition, pump prices in the country are expected to rise from September 16th 2017.

This will primarily be because of the anticipated rise in global demand for crude oil – particularly from the US at least by 1.5 million barrels per day (1.4 million bpd according to Goldman Sachs).

The United States, at the dawn of its summer driving season which witnessed ten of its refineries  - in the Texas energy hub shut down and leaving the world’s number consumer of the product losing an aggregate of 2 million barrels of crude oil daily: a gap that was since then supplemented by other sources in the global market (including Ghana).

On the basis of these developments in the global market, Ghana’s ex-pump prices are expected to be significantly impacted from the later part of this month [September] – particularly, because of the country’s net-import status that makes it a price taker in the global crude oil market: one vulnerable to all the changes dictated by the big players, strength of the US dollar exchange, among others.

Â

Â