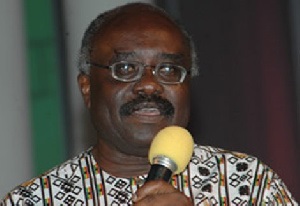

Dr Charles Wereko-Brobby, a former Chief Executive Officer of the Volta River Authority (VRA) has attributed the collapse of some 23 savings and loans companies to the lack of supervision from the Bank of Ghana, BoG.

Speaking on Joy FM's news analysis programme 'NewsFile', Dr Charles Wereko-Brobby blamed cronyism and exceptionalism for the various issues the country is facing in the banking sector.

"We have Bank of Ghana who has a supervision division, presumably it is supposed to be a sustained supervision all these companies are supposed to submit regular returns and it seems all the fine rules we have are always set aside largely because of cronyism and exceptionalism until we begin to take to task whose you are to make sure things are done properly we are going to get into this mess all the time.."Â Â Â

"Clearly there is poor supervision, clearly no one is being held responsible..," he added.Â

Licence revocation

The Bank of Ghana, BoG on Friday, August 16 revoked the licences of twenty-three (23) insolvent savings and loans companies and finance house companies.

The central bank in a statement on Friday said the revocation of the licences of these institutions has become necessary because they are insolvent even after a reasonable period within which the Bank of Ghana had engaged with them in the hope that they would be recapitalized by their shareholders to return them to solvency.â€

“It is the Bank of Ghana’s assessment that these institutions have no reasonable prospects of recovery, and that their continued existence poses severe risks to the stability of the financial system and to the interests of their depositors,†the statement added.

BoG in the statement explained that the actions “were taken pursuant to Section 123 (1) of the Banks and Specialised Deposit-Taking Institutions Act, 2016 (Act 930), which requires the Bank of Ghana to revoke the licence of a Bank or Specialised Deposit-Taking Institution (SDI) where the Bank of Ghana determines that the institution is insolvent. The Bank of Ghana has also appointed Mr Eric Nipah as a Receiver for the specified institutions in line with section 123 (2) of Act 930.â€

Assurance to customersÂ

BoG has also assured that funds are available to pay customers of the 23 finance houses and savings and loans companies whose licences were revoked today.

The Central Bank says it has provided funds to ensure that the Receiver of the financial entities, whose licences have been revoked, will pay the affected customers.

“The Government has made available funds to enable the Receiver to pay depositors of the savings and loans companies and finance houses after validation of their claims. Other creditors of the failed institutions will be settled by the Receiver in line with the hierarchy or priority of creditors’ claims set out under Act 930,†the Bank of Ghana said in a statement.

READ ALSO :

Â