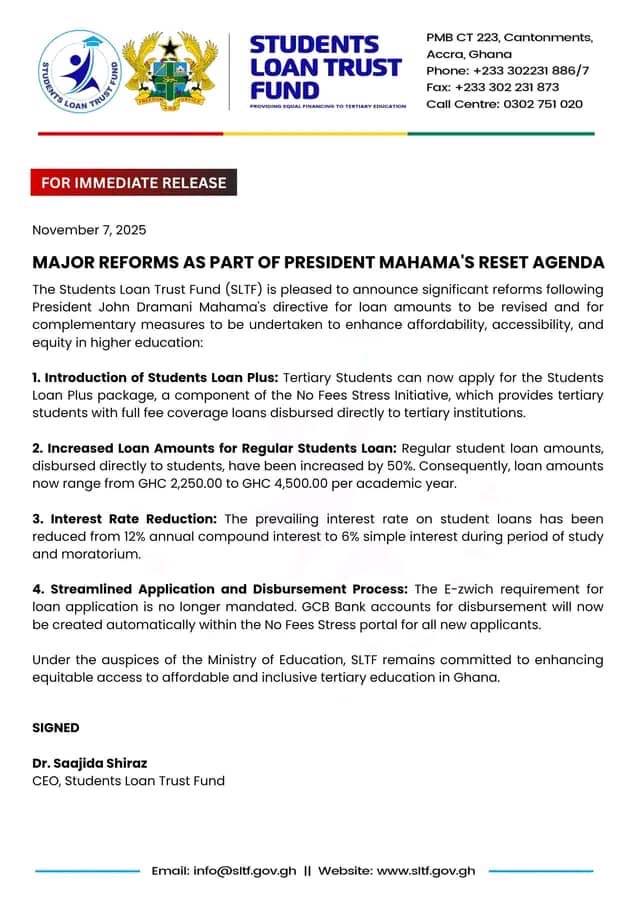

The Students Loan Trust Fund (SLTF) has announced a 50% increase in loan amounts available to tertiary students as part of wide-ranging reforms introduced under President John Dramani Mahama’s Reset Agenda.

Unveiled on November 7, 2025, the new measures aim to make higher education more affordable and accessible to all qualified students, regardless of financial background.

In a statement signed by Dr. Saajida Shiraz, Chief Executive Officer of the SLTF, the Fund explained that the increment forms part of government efforts to strengthen equity and affordability in Ghana’s tertiary education system.

Under the revised structure, loan disbursements for regular students have been increased by 50%, with amounts now ranging between GH¢2,250 and GH¢4,500 per academic year. The loans will continue to be paid directly to beneficiaries.

“Following President Mahama’s directive, loan amounts have been reviewed upward to reflect current economic realities and to provide meaningful support to students,” the statement read.

Beyond the increment, several major reforms have also been introduced, including:

- Students Loan Plus: A new full fee coverage package disbursed directly to tertiary institutions.

- Interest Rate Reduction: From 12% compound to 6% simple interest during the study and moratorium period.

- Simplified Application Process: The removal of the E-zwich requirement, with GCB Bank accounts automatically created through the No Fees Stress portal for seamless access and faster disbursement.

Dr. Shiraz emphasized that these interventions reaffirm the government’s commitment to building an inclusive and sustainable education system.

“Under the auspices of the Ministry of Education, the SLTF remains dedicated to ensuring equitable access to affordable tertiary education in Ghana,” she said.

The reforms form part of President Mahama’s No Fees Stress Initiative, a flagship policy under his Reset Agenda, which aims to reduce financial barriers for students and enhance the country’s human capital development.