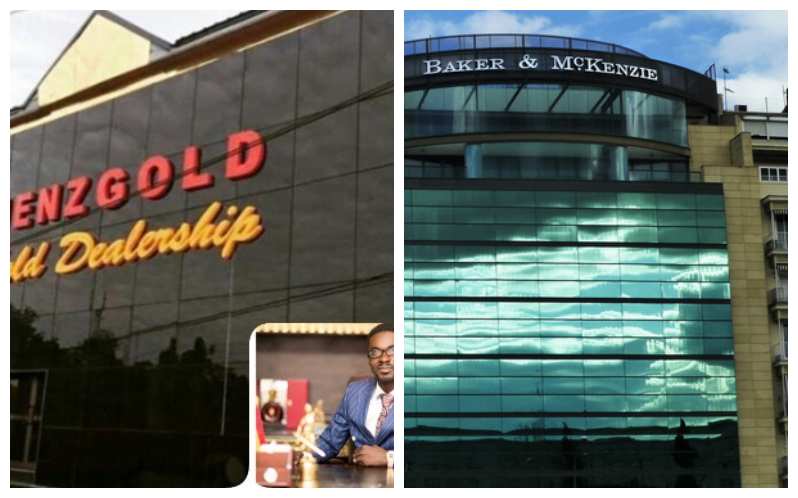

Menzgold Company with business interests in London, Spain and Nigeria, has engaged the services of UK and Wales based law firm, Baker & McKenzie LLP to join forces with their local counsel, Kwame Akuffo & Co. Unlimited to take up its current spat with the Securities and Exchange Commission.

The Commission on September 7, directed Menzgold to suspend its trading activities because it was not licensed to do so, a decision that has engendered bitter discussions and panic among the company’s investors.

But the law firm has in a letter dated September 14, 2018 and addressed to the Deputy Director-General of SEC, Mr Paul Ababio and copied to the Chief Executive Officer of the Minerals Commission, served notice it will in the next few days set out why it is convinced that Menzgold has done no wrong to deserve a shutdown of its operations.

“The Company will, as a demonstration of good faith and willingness to fully cooperate with the SEC while this matter is resolved, desist in these specific activities outlined in the SEC Communications.

“This voluntary and temporary cessation of these alleged activities is without prejudice to the Company's legal position nor any acknowledgement of wrongdoing in any way. It is a simple gesture of good faith to give all pause for consideration of the technical legal issues and to allow its lawyers to fully engage with the SEC on this matter.â€

The Securities and Exchange Commission, SEC wrote to Menzgold Ghana Company, to shut down all investment trading in gold.

In the 3 September 2018 letter signed by Deputy Director General, Paul Ababio, the SEC said: "In September 2017, the SEC issued a public notice indicating that it does not regulate Menzgold. The SEC began further investigations into the activities of Menzgold in July 2018. In August 2018, the Commission called for an inter-sectoral meeting that involved the Minerals Commission, Bank of Ghana and the Securities and Exchange Commission. The Meeting concluded that it is evident Menzgold’s activities appear to go beyond the mandate authorised in its licence".

The SEC said: "It is our expectation that being your licencee, MINCOM, would call Menzgold to order and direct it to conduct its business in accordance with the licence issued to it by MINCOM".

The September 3, 2018 letter from SEC stated  added that failure by Menzgold to comply with the directive “will lead to the SEC employing other relevant measures under the law to enforce compliance.â€

Meanwhile Mr. Kwame Akuffo of Kwame Akuffo & Co Unlimited, local legal representatives of Menzgold, is raising questions about the fairness of SEC’s suspension of trading directive, saying the decision is also surprising and seemingly premature.

In a letter to acknowledge receipt of SEC’s letter announcing Tuesday’s meeting, Kwame Akuffo says it appears SEC, having taken the decision to suspend Menzgold’s trading activities, is now asking for the information that should have guided its decision to suspend or not.

“You will recall that pursuant to your letter dated September 7, 2018, in which you took a decision to shut down our Client's business, we wrote to you requesting for a meeting to resolve the issues arising therefrom.

“It is instructive to note, that in paragraph 4 of your letter dated September 7, 2018, you stated;

"Subsequent to the visit by the SEC officials, a request for specific detailed information was made and Menzgold has through its Lawyers agreed to provide the necessary information requested by SEC within fourteen days. The provision of the information however does not make that aspect of Menzgold's operations any less of an illegality under Act 929 as well as a threat to unsuspecting and uninformed investors."

“Indeed, you were absolutely clear that the said "information" was completely irrelevant for purposes of your decision. It was without receipt of this "information" that you proceeded to order a complete shut down.

“It is therefore a matter of surprise that we are now being told that we are to furnish you with "information" that you did not consider relevant and above all were emphatic that the said "information" would have had no bearing on your decision to shut down our Client' business.

“It is settled practice that decision makers such as administrative bodies and the Courts which take decisions affecting the rights of others do not as a general rule receive evidence after a decision has been given. On the facts of this case, you have specifically informed us that the "information" does not matter.

“Your letter, therefore, raises fundamental questions as to the fairness of the decision you took on September 7, 2018, as well as whether same was premature. Under the circumstances, it is difficult for us to reconcile the contents of your letters dated September 7, 2018 and September 13, 2018.â€