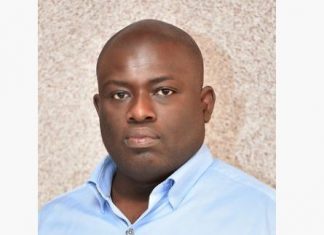

The Managing Director for Tema Oil Refinery, TOR, Mr Kweku Asante Berko has resigned after being charged by U.S SEC for breaching the Foreign Corrupt Practices Act, FCPA.

A statement from the presidency signed by the Communications Director, Eugene Arhin said the President has accepted his resignation.Â

READ ALSO : Current MD for TOR charged by U.S SEC for alleged FCPA breaches

Asante Berko in a statement yesterday denied the bribery allegation by the U.S SEC.

He said in the statement that " his attention has been drawn to reportage in the local and international news media, as well as documents on social media on the morning of 14th April 2020. The essence of the story is that the SECin the US has issued civil proceedings against me, alleging that I bribed government officials and Members of Parliament in Ghana to enable a Turkish IPP to secure a Power Purchase Agreement."

“While it is true that the SEC has just this week issued such proceedings against me, the allegations that government officials and Members of Parliament were bribed by me are completely false.â€

He added “I state categorically that I have not paid any bribes to government officials, Members of Parliament nor any officials of Parliament. I have had no contact with Members of Parliament nor officials of Parliament, regarding the approval of this transaction.â€

Background

The Securities and Exchange Commission alleges that Asante Berko, a former executive at Goldman's London subsidiary, facilitated as much as $4.5 million in bribes to help a Turkish energy company win a contract to build a power plant. The SEC says the energy company, which wasn't named, funnelled money to an intermediary, which then paid bribes to Ghanaian government officials.

Mr. Berko also personally paid bribes totalling $66,000 to members of the Ghanaian parliament and other government officials, the SEC alleges. The said bribery transaction occurred within a period from 2015 to sometime in 2016.

An attorney for Mr. Asante Berko declined to comment on the lawsuit, which accuses Mr. Berko of violating the Foreign Corrupt Practices Act. That law bars individuals and companies from giving anything of value to overseas officials to win business.

The SEC said in a press release that Mr. Berko tried to hide the scheme from the bank, whose compliance officers questioned how the deal was put together. Goldman, which wasn't named in the SEC's lawsuit, terminated its involvement with the project after the energy company refused to explain the intermediary firm's role, the SEC's legal complaint says.

"Goldman Sachs fully cooperated with the SEC's investigation and as stated by the SEC in its press release, the firm's compliance personnel took appropriate steps to prevent the firm from participating in the transaction," said Nicole Sharp, a spokeswoman for Goldman.

The energy company paid Mr. Asante Berko $2 million for successfully coordinating the effort, the SEC alleges. The payments violated Mr. Berko's employment agreement with the bank, the SEC's lawsuit says.

Mr. Asante Berko knew the bank stood to earn $10 million in fees if the energy company won the contract and organized financing for it, the lawsuit alleges. The deal would have "enhanced Berko's performance and stature within" the bank, according to the SEC's complaint.

In the suit, which was filed in Brooklyn federal court, the SEC asks for Mr. Asante Berko to pay fines and give back any compensation he earned through the scheme.