The sale of Newcastle United moved nearer on Thursday after PCP Capital Partners, the investment company run by Amanda Staveley, signed a confidentiality agreement with the club's owners.

Staveley's organisation will now begin a period of due diligence of club finances after Sky Sports News revealed on Monday that owner Mike Ashley had put the club up for sale - and wants a deal completed by Christmas.

Ashley is rumoured to want around £400m for the club, according to sources in the north east.

PCP Capital Partners are understood to be taking a close look at as many as three Premier League clubs, including Liverpool.

It is understood that reports of a £300m bid from Staveley are premature - with a formal offer not expected until accountants have pored over the club's books.

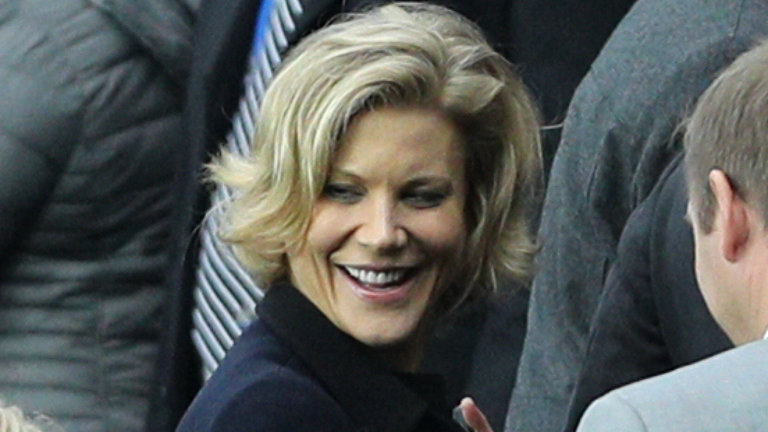

Staveley was spotted in the directors' box at St James' Park when Newcastle hosted Liverpool in front of 52,000 fans.

The 44-year old financial guru manages more than £28bn of global assets and has built up contacts in boardrooms across the UK over the past decade and has made no secret of her interest in investing in the Premier League.

Ashley, who told Sky Sports News earlier this year he does not have the money to compete with the top clubs, bought Newcastle for £134m 10 years ago. The club presently sits 9th in the Premier League table.

Ashley's lawyer Andrew Henderson released a statement on Thursday saying: "Since Monday, a number of additional parties have come forward which we believe to be credible.

"We are also continuing to engage with a number of parties with whom we had entered into negotiations prior to Monday's announcement."

Staveley has been credited as the driving force behind Barclays £5.5bn rescue package from funds in Abu Dhabi and Qatar which secured the bank's future in 2008.

And she is presently suing the same bank for £1.2bn after financial irregularities became public following a Serious Fraud Office investigation into that deal.