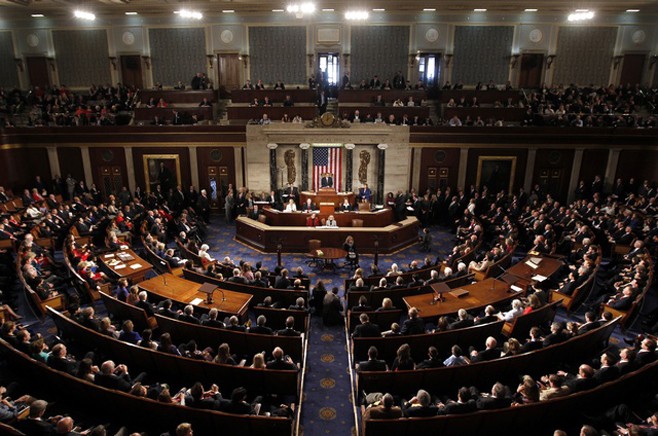

The US Senate has approved the most sweeping overhaul of the US tax system in more than three decades.

Republicans say the tax cuts for corporations, small businesses and individuals will boost economic growth.

Democrats, who all voted against it, say it is designed to benefit the ultra-rich at the expense of the national deficit.

For final approval, the legislation must go back to the House on Wednesday for a procedural issue.

If it passes, as expected, it will be President Donald Trump's first major legislative triumph.

Vice-President Mike Pence presided over the vote and announced the result.

"On this vote, the ayes are 51, the nays are 48. The Tax Cuts and Jobs Act is passed," he said.

Shortly before the final tally was announced, protesters in the Senate's public gallery shouted: "kill the bill". They were escorted out.Â

{loadmodule mod_banners,nativeads}

Corporate taxes will pay 21%, instead of the current rate, which varies between 15% and 35%.

It will also lower individual tax rates, albeit temporarily.

Other key elements include:

- Less inheritance tax

- An expanded child tax credit

- Lower taxes on overseas profits

It is good news for businesses, particularly multinational corporations and the commercial property industry.

The extremely wealthy and parents sending their children to private schools are set to benefit.

However, families living in high-tax, high-cost states could lose out, so could those paying for their own health insurance.

In the immediate future, the plan will see the vast majority of taxpayers having lower tax bills, but the cuts expire in 2025

www.primenewsghana.com/Â Ghana News