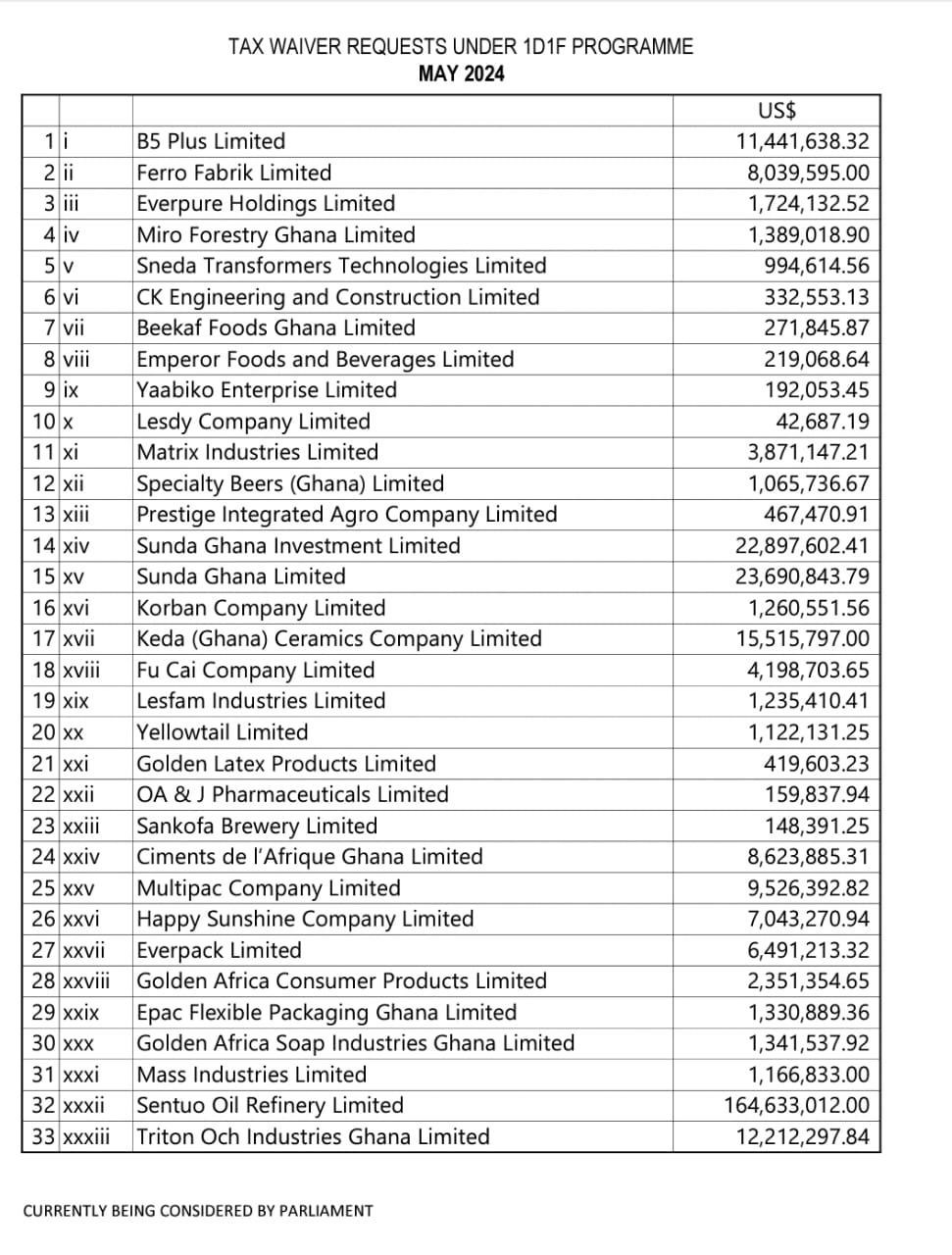

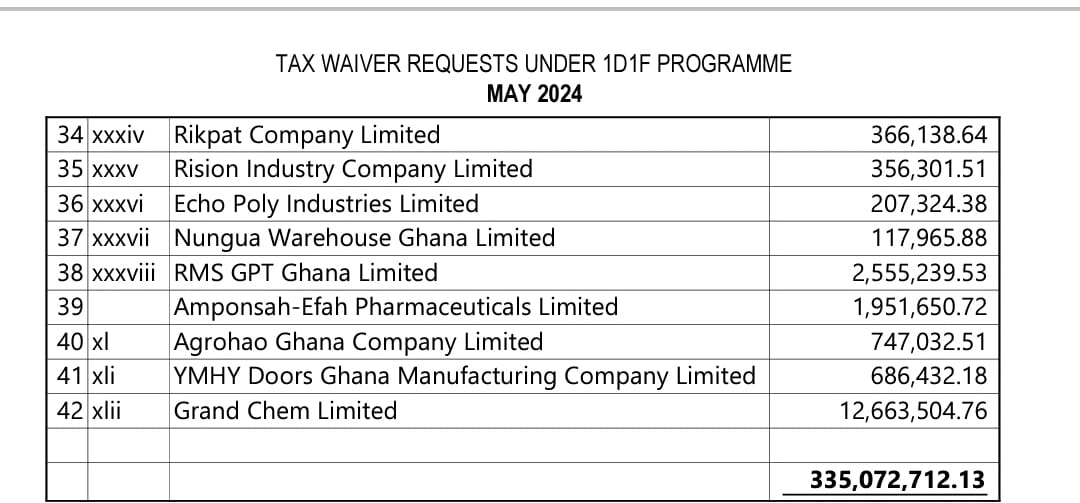

The list of 42 companies to benefit from approximately $335,072,712.13 tax exemptions under the One District One Factory (1D1F) initiative has popped up.

The Exemptions Act, 2022 (Act 1083) was laid in Parliament by the former Finance Minister, Ken Ofori-Atta, in 2022.

This was after the Ministry commenced processes to secure the waivers to boost the companies.

The Chinese-owned company, Sentuo Oil Refinery Limited has the highest figure of $164,633,012.00 the list awaits parliamentary consideration and approval.

Other beneficiaries will include; Ferro Fabrik Limited, Everpure Holdings Limited, Fu Cai Company, Nungua Warehouse Company among others.

The tax waivers are in the areas of Import Duties, GET Fund Levy, Import NHIL, Import VAT and EXIM Levy on materials, plants, machinery and equipment or parts to be imported.