All financial remittances will be linked to the biometric information on recipients’ Ghana Card to help address issues of fraudulent accounts.

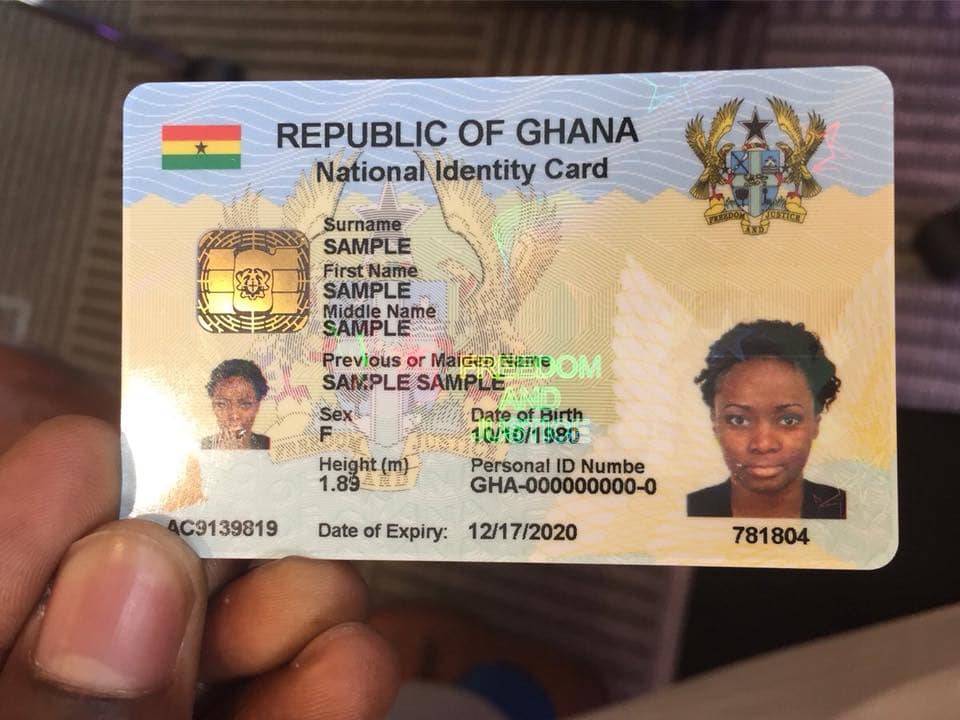

The Head of the Financial Division of the Ministry of Finance, Mr Sampson Akligoh, who disclosed this, said the move would come into effect after the integration of the Ghana card, the biometric national identification card, with major ID numbers in the country.

Currently, processes have started for the replacement of key ID numbers such as Tax Identification Numbers (TINs) and Social Security numbers with Ghana card numbers to be used as universal ID cards in the country.

Speaking at a stakeholders’ dialogue on remittances in Accra last Wednesday, Mr Akligoh said the linkage of accounts with biometric information would be augmented by the development of consumer protection regulations, particularly in the areas of disclosure for both inward and outbound remittances.

He said there was no consumer protection legislation specific to international money transfers, a situation that could make consumers at the receiving end vulnerable to additional undisclosed charges of transactions.

Mr Akligoh said the integration would also facilitate the flow of remittances through formal channels to low-income Ghanaians and people in rural areas, and, in the process, enhance the impact of remittances on economic growth and poverty reduction, while eliminating fraud.

“Encouraging remittances through banking channels can improve the development impact of remittances and encourage a saving culture among recipients, since remittances received as cash are less likely to be saved than those received through a bank account,†he said.

Improving access

Mr Akligoh noted that whereas emigration from Ghana had slowed down over the last five years, in-bound remittances had seen a consistent growth, making Ghana the second largest receiver of such in sub-Saharan Africa, after Nigeria.

Improvement in access to remittance services, particularly in rural and remote areas, by encouraging the participation of microfinance institution, credit unions and saving banks (including postal saving schemes) in the remittance market, remained key, he said.

“Besides encouraging savings from remittances, these financial intermediaries can develop remittance-linked consumer or housing loans and insurance products. Therefore, existing regulations may need to be amended to allow these institutions to fully participate in providing remittance services,†Mr Akligoh said.