The Chamber of Petroleum Consumers Ghana (COPEC-Ghana) has warned Ghanaians to brace up for a never-ending cycle of fuel price increases in the days ahead.

This gloomy prediction follows a surreptitious increase in prices of petroleum products over the weekend at fuel stations by some 3%, just three weeks after a 12% increase.Â

With a litre of petrol hitting GH¢6.230 ($1.07) at pumps because of the recent marginal increase, there is sure to be an attendant high cost of living.

High cost for fuel is bad for the economy because fuel price hikes translate into more money to buy the same quantity of fuel at the pump, which then leaves less money to spend on other goods and services.Â

But it gets more serious at the macroeconomic level when fuel prices go up. In Ghana, the structure of the economy means that even a marginal increase in fuel price affects transport fares which then drives up the cost of living.

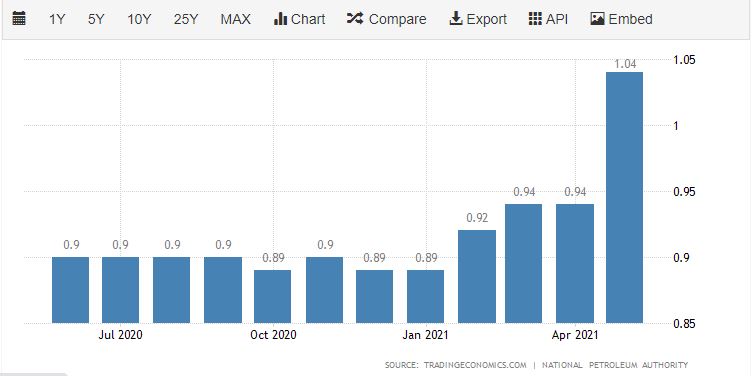

Despite Ghana holding between 5 to 7 billion barrels of crude at Jubilee and other fields, there has been approximately 29.7% cumulative increase in petroleum prices between October 2020 and now.

This according to COPEC-Ghana points to troubling economic times ahead and a burden to consumers of petroleum products in Ghana.

TOR’s failure

COPEC-Ghana, a champion of sustainable and broadâ€based improvements in the downstream petroleum sector, and a foremost petroleum sector think tank, foresees even tougher times ahead for Ghanaians with regards to the cost of fuel.

COPEC-Ghana Executive Secretary, Duncan Amoah, says a deeply dysfunctional petroleum sector has meant Ghanaian consumers will always bear the brunt of the endless incidence of fuel price hikes.

READ ALSO:Â Three-member management committee to revamp TOR sworn in

“The failings of Bulk Oil Storage and Transportation Company Limited (BOST) and Tema Oil Refinery (TOR) and taxes will make the consumer continue to pay more for fuel,†he told Prime News in an exclusive interview.

According to him, TOR’s inability to live up to its founding objective when it was set up in the 60s is among the biggest contributors to the problems in Ghana’s petroleum sector.

“Dr Kwame Nkrumah saw that Ghana was going to get crude in commercial quantities [so he built TOR]…the understanding is that once you start producing crude in commercial quantities, your refinery will be on hand to process the oil for the local market but since 2010 TOR has been on its knees,†Duncan Amoah lamented.

According to the COPEC Executive Secretary, a recent inauguration of a three-member Interim Management Committee (IMC) by the Energy Minister, Dr Matthew Opoku Prempeh, to revamp TOR is a step in the right direction buy belated.

“The refinery is not working to provide you with the security you need. Look at the logistical cost involved in importing fuel is a huge one. You now have to send the crude that we take from Jubilee Field to refineries in Europe with hard currency, dollars, to import back to Ghana the finished product. So, our freight cost is double, insurance is double and the cost of everything will be high…meanwhile, you have a refinery sitting in Ghana,†he recounted.

According to him, these costs have a direct bearing on the price of petroleum products at the pump.

BOST problem

Another reason Ghanaians are having to pay more for fuel is BOST’s inability to serve its purpose. BOST should be serving as a buffer to cushion consumers when international market conditions are harsh, but the company is engaged in other activities, the COPEC-Ghana Executive Security said.

“Last year, the price of finished products dropped from $628 per metric tonne to $170 at a point, COPEC-Ghana wrote to the government and said BOST should be given the resources to keep strategic stock for Ghanaians because the price will go up again, but not a single litre was procured,†he said.

He said this is not the first time BOST has failed to take advantage of a fall in fuel prices internationally.

Preponderance of taxes

Then there is the government's insatiable hunger for taxes on petroleum products that compounds the whole situation.Â

COPEC-Ghana said efforts to get Parliament to put a ceiling on how much taxes can be slapped on petroleum products by the government has been strangely unsuccessful.

"At the time world market prices of crude was going up, Ghana's Finance Minister was also pushing for more taxes on petroleum products. So these are the things that have gotten us to where we are today," he said.

Three taxes have been slapped on petroleum products recently. Following the imposition of an Energy Sector Recovery Levy, the following taxes apply: 20 Ghana pesewas per litre on petrol/diesel, 18 Ghana pesewas per kg on Liquefied Petroleum Gas (LPG) and a Sanitation and Pollution Levy of 10 Ghana pesewas per litre of petrol and diesel.

Before these taxes, the following pertain for petrol: Excise Duty, 2.78 Ghana pesewas per litre; Energy Debt Recovery Levy, 41 Ghana pesewas per litre; Road Fund Levy, 40 Ghana pesewas per litre; Energy Fund Levy, 1 Ghana pesewas per litre; Price Stabilisation and Recovery Levy, 12 Ghana pesewas per litre.

Other margins are Primary Distribution Margin, 4.5 Ghana pesewas per litre; BOST Margin, 3 Ghana pesewas per litre; and Fuel Marketing Margin, 1.5 Ghana pesewas per litre.

Meanwhile, each tax component and margin attract a 17.5% Value Added Tax (VAT), charged on the consumer.

For diesel, the tax components are as follows: Excise Duty, 1.8 Ghana pesewas per litre; Energy debt recovery levy, 41 Ghana pesewas per litre; Road Fund Levy, 40 Ghana pesewas per litre; Energy Fund Levy, 1 Ghana pesewa per litre; Price Stabilisation and Recovery Levy, 10 Ghana pesewas per litre.

Other margins are Primary Distribution Margin, 4.5 pesewas per litre; BOST Margin, 3 pesewas per litre; and Fuel Marketing Margin, 1.5 pesewas per litre.

All the above taxes exclude the actual price of the product, which also attracts 17.5% VAT.

COPEC-Ghana says the cycle of volatile fuel prices will persist unless the system begins to work.