Said Weah: “To the private sector, I say to you that Liberia is open for business. We want to be known as a business-friendly government.

We will do all that is within our power to provide an environment that will be conducive for the conduct of honest and transparent business. We will remove unnecessary regulatory constraints that tend to impede the establishment and operation of business in a profitable and predictable manner.â€

Weah’s inauguration speech later drew critical reviews but it was his optimism about attracting investors to a country of over 4.5 million people that did generate some applause.

Before Weah took the helm, Liberia was gradually resuscitating from a turbulent economic situation created by the Ebola outbreak and slump in the price of major exports on the world market.

In 2017, the country’s economy was showing signs of modest recovery with a Gross domestic product (GDP) growth of an estimated 2.5% compared to a deceleration of 1.6% in 2016 and zero percent growth in 2015, according to the World Bank.

The mining sector grew by 29% in the first quarter of 2017, while non-mining sector grew by 0.2%. But, the agriculture and service sectors showed sluggish performance as inflation averaged at 12.5% in 2017 compared to 8.5% in 2016 mainly because of the depreciating Liberia dollar.

It’s now more than nine months into Weah’s reign and the cloud of uncertainties are becoming perceptible, casting more doubts over the economic recovery.

And while new data of a comprehensive economic climate remains unavailable, economists have emphasized that a weaker private sector would plunge the economy into more distress.

Index Report Signals Danger

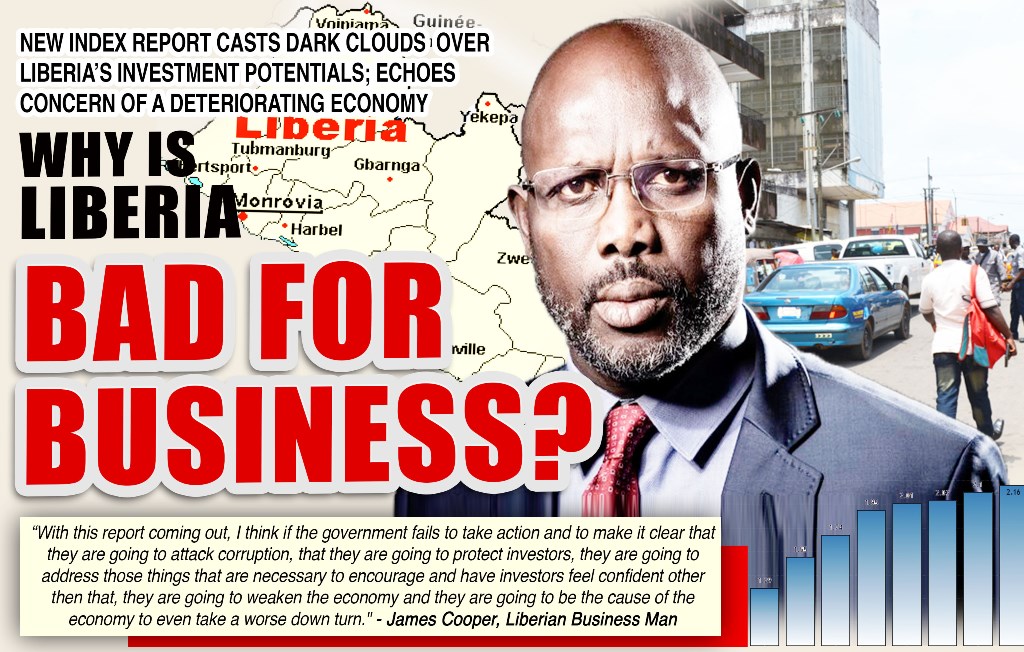

This week, American business magazine Forbes, which conducts studies of countries business climate, ranked Liberia as the first on the list of the top 10 worst destinations for doing business.

In simple terms, the magazine is cautioning foreign investors not to venture into pouring their moneys into the country.

The ranking is tallied after evaluation of the level of innovation, taxes, technology, corruption, freedom (personal, trade and monetary), red tape and investor protection of a particular country.

Liberia, which has a GDP of US$2 billion, is below DR Congo, Mauritania, Togo, Zimbabwe, Burundi, Guinea, Libya, Gambia, and Chad on the index.

South Africa, Morocco and Rwanda are three African countries that scored impressive on the list of countries suitable for investment.

Bad Press, Bad Image

The Forbes report comes as the Liberian government struggles to change the narrative of a reported missing L$16 billion. Observers say the handling of the saga has injured the country’s reputation off the home front, consequently diminishing its chances of attracting potential investors.

Foreign relations expert Dr. Augustine Konneh told FPA that the government’s handling of the missing billions has created ‘a scene of anarchy’ as a result of the conflicting pieces of information to the public, thereby raising doubt about the country’s ability to handle matter of finances.

“There is uncertainty; the President himself admitted to that – that his colleagues were asking him about the containers [at the UN General Assembly]. The US Federal Reserve decided to freeze the CBL account because of the uncertainty,†he said.

“So, it’s left with the international community to make a judgment; and it creates a signal of whether to trust or un-trust [Liberia]. [But] It will be difficult for people to trust you.â€

Experts maintain that the government’s apparent inability to independently probe the saga void of conflict of interest is also raising many international observers’ eyebrows.

High Corruption Perception

Already, Liberia had scored low in the 2017 corruption perception index compiled by Transparency International. Liberia ranks 122 out of a total of 180 countries. Transparency International, through its local auxiliary in Monrovia – Center For Transparency and Accountability (CENTAL) – proffered several recommendations to the Weah-led government including “cleaning up and tackling corruptionâ€

In late July this year, the vice president for Middle East-Africa of the International Financial Corporation – a member of the World Bank Group – also stressed that Liberia’s development clings on the vibrancy of its private sector, calling on the government to lessen uncertainties for investors.

Sergio Pimenta stressed that limiting uncertainties would allow foreign investors see potential opportunities to invest in the country, which will enhance the collaboration of both domestic and foreign private investors.

Liberian Investors’ Apprehension

Meanwhile, some major actors of Liberia’s economy have expressed concern about the latest Forbes index report; some are contending that it would thwart ongoing efforts to clinch deals with foreign investors.

Several Liberians are worried that the strides they have made to lure investors to the country risk collapse.

James Cooper, CEO of the Copper Farm Rubber Purchasing Plant in Bomi County, describes the Forbes report as “devastating†for Liberia.

He said the problems that are occurring domestically have sent wrong signals internationally; adding, “When the government doesn’t address these issues by taking substantive actions, the situation would get worse.â€

Cooper, who owns the only Liberian rubber processing company and exports to Asia and the United States, attracted massive attention from the media when he released a secret recording of Bomi County Senator Sando Johnson, who is the Liberian Senate Chairman on Concessions.

The recording renewed concerns about the corruption threats private investors endure in the country. In the recording, Senator Johnson is allegedly heard demanding over US$500,000 as bribe before sanctioning the disbursement of a certain fund intended to empower the local rubber industry.

Cooper claimed he had ever since submitted the complaint to the government but it has been swept under the carpet.

“Look at my situation with the Chairman of the Senate Committee on Concessions – it’s mouth-spoken [by Johnson himself] and it’s in front of them: the Justice Minister, Speaker of the House and the President have all been informed but nothing is being done,†he said.

“So when you have that failure on the part of the government that does nothing then it sends a very negative signal to investors out there.â€

Nevertheless, Cooper has been attracting Asian investors to pour funds into his company with an ambition of leaping into manufacturing very soon. But it seems that the chances are narrowing.

“With this report coming out, I think if the government fails to take action and to make it clear that they are going to attack corruption that they are going to protect investors; they are going to address those things that are necessary to encourage and have investors feel confident then they are going to weaken the economy and they are going to be the cause of the economy to even take a worse down turn,†he said.

Meanwhile, the former Secretary General of the Liberia Business Association (LIBA) Leelai M. Kpukuyou has blamed the situation on the government’s slow pace in reducing bottlenecks associated with regulating the investment sector.

“In the past the business people or investors used to take like two days to get their business registered, but now as we speak, it takes more than two or three weeks to get your business documents ready, that is also contributing to the problem,†she said.

Source: frontpageafrica