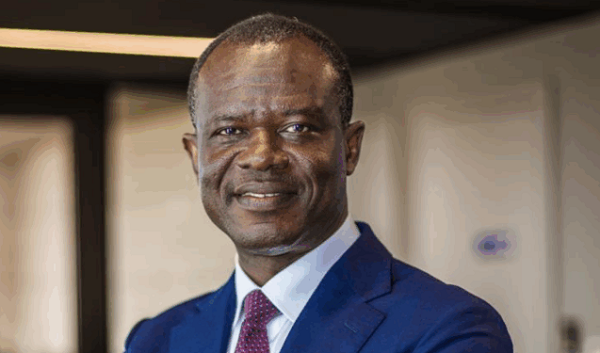

Nearly seven out of every ten Ghanaians lack basic financial knowledge, leaving them exposed to poor financial choices and predatory schemes, the First Deputy Governor of the Bank of Ghana (BoG), Dr. Zakari Mumuni, has disclosed.

“Nearly 68% of our society, and indeed Ghana, are deemed to be financially illiterate. This means too many of our citizens are vulnerable to poor financial conditions, unsustainable debts, and painful losses that come with unregulated investment schemes,” Dr Mumuni stated.

He made the remarks during the launch of four financial literacy books authored by Ghanaian financial expert, Korsi Dzokoto, in Accra on Monday, September 22, 2025.

Dr Mumuni stressed that financial literacy is no longer a luxury but a necessity in Ghana’s increasingly complex financial landscape.

“Every Ghanaian, from the market woman to the young graduate entering the labour market, needs financial literacy lessons. This is one area where we have been working very assiduously to get people to speak on financial literacy issues,” he added.

According to him, the central bank has intensified its efforts in consumer protection, financial inclusion, and public education, particularly through schools and communities, to enhance financial awareness and resilience. He also pointed out that BoG has been engaging journalists covering monetary policy to improve how such issues are communicated to the public.

On the relevance of the four books launched, Dr Mumuni lauded their simplicity and practicality. “What makes these four books so valuable is their accessibility. They are simple, practical, and offer lessons that children, parents, teachers, and everyday citizens can understand and apply,” he said.

He explained that the books cover core aspects of financial management, including saving and investing, risk and reward, and navigating the financial landscape. Importantly, he highlighted three dimensions essential to financial empowerment which are: awareness and knowledge, practical skills and behaviour, and attitudes that shape financial decisions.

“These books are more than publications. Indeed, they are tools of empowerment,” Dr Mumuni remarked. “May they travel far and wide into homes and schools across the country and may they light the path towards overcoming financial illiteracy.”

Norvanreports