The recent debate over the proposed e-levy tax has put the spotlight very intensely on the subject of taxpaying attitudes in Ghana.

Ghanaian politicians regularly chastise their fellow citizens for being entitled windbags who complain constantly about every minute failing of the government in providing services and amenities. Lamentably, in the view of the politicians, these same Ghanaians slink down their holes when asked to pay their fair share of tax for the government to obtain the resources needed to meet all their noisy demands.

One former Minister is categorical: Ghanaians just don’t like paying taxes. An activist of the ruling party implicates “dirty politicking” in this attitude of rampant tax dislike and evasion. According to the country’s serving Finance Minister, only 8.2% of working Ghanaians pay tax.

As far as some politicians would have it, a vast proportion of the population is literally made up of “tax thieves” blatantly stealing from the state that which morally and legally belongs to it.

Yet many Ghanaians disagree with the politicians about this alleged aversion to tax.

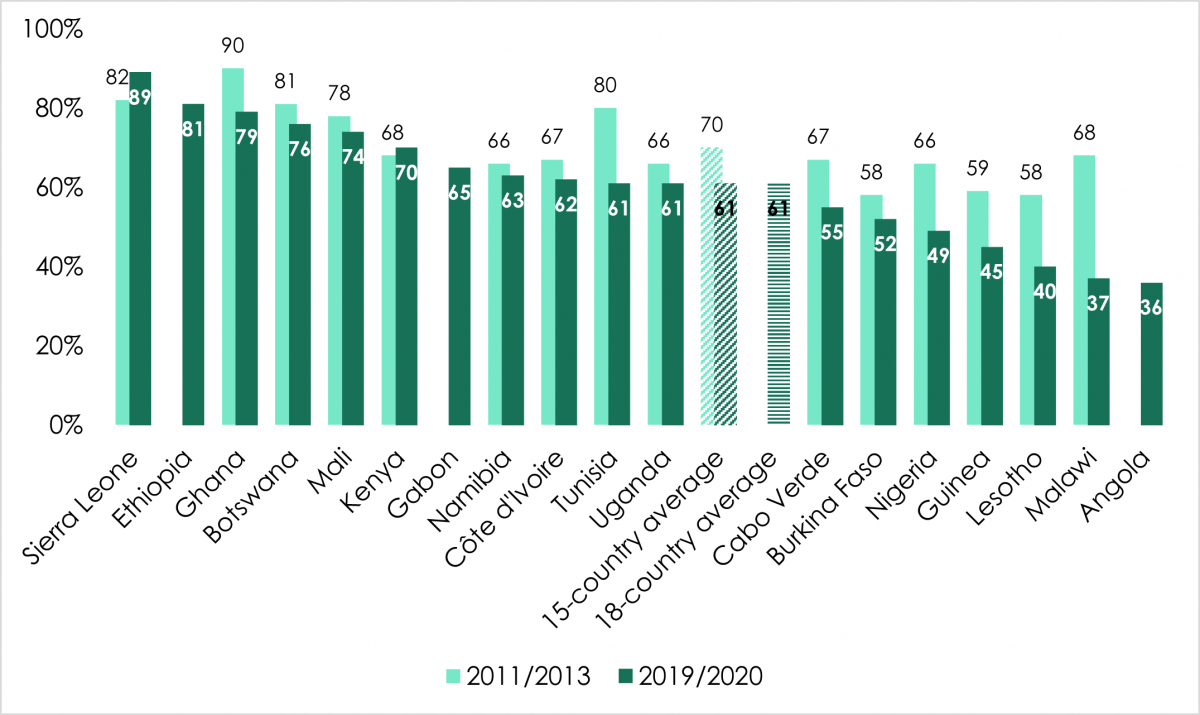

72% of the country’s residents tell AfroBarometer (2019) that they will gladly pay more tax to support the government to deliver on its mandate.

Ghanaians express a far greater willingness to back Government’s tax-levying power than citizens of most other African countries according to AfroBarometer surveys. Even if 10 years of watching politicians pour money down the drain has dampened that enthusiasm a bit (from 90% down to 79%).

Of course, there is no country on Earth where more vigilance and diligence in tax collection would not yield more government revenue.

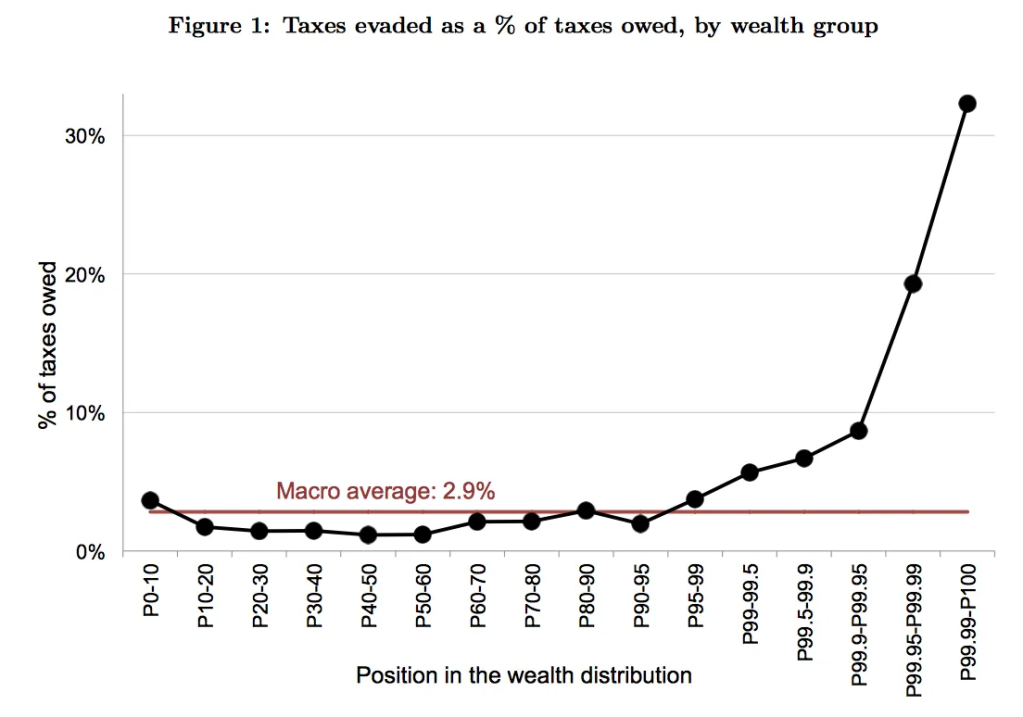

Even in fabulously high-solidarity and egalitarian Scandinavia, Matthew Yglesias estimates that the top 1% of income earners (i.e. rich people) evade 30% of true tax due.

Every government therefore can be expected to try to do more to prevent tax evasion and to minimise unethical tax avoidance. Where we have a problem is when attempts are made to suggest that the situation in Ghana with regard to taxation is particularly dire because Ghanaians are exceptionally unscrupulous and anti-tax. I disagree simply for the reason that the data simply doesn’t support the claims.

Seriously the Finance Minister ought to fire some of his research assistants. Throughout this e-levy debate, they have failed to furnish him with sound data and advice. The claim, made in the international press no less, that only 8.2% of working Ghanaians pay tax is extremely distressing. There is no grounding in fact for this belief.

According to the Ghana Revenue Authority, which reports to the Finance Ministry, 6.6 million Ghanaians file taxes. Based on the provisional results of the latest census in Ghana (2020, postponed to 2021), the true labour force (economically active citizens) of Ghana is just a little under ten million. Thus, depending on whom you believe, the number of tax paying individuals is either a high of 57% of the population (not adjusting for the “economically active but currently unemployed” to allow for easier subsequent comparisons across countries), according to the Tax Authorities. Even if we were to use the Finance Ministry’s own curious compliance data, the resulting figure would be 20.5%. Not 8.2%.

The Finance Ministry does have a point, however, when it complains that the amount of money made in the economy that goes to the government (approximated by the metric known as “tax revenue/GDP”) is smaller than in more developed countries around the world. I have addressed that issue more fully here.

There are many caveats to bear in mind when comparing how much other governments are able to squeeze out of their economy, compared to Ghana’s, however.

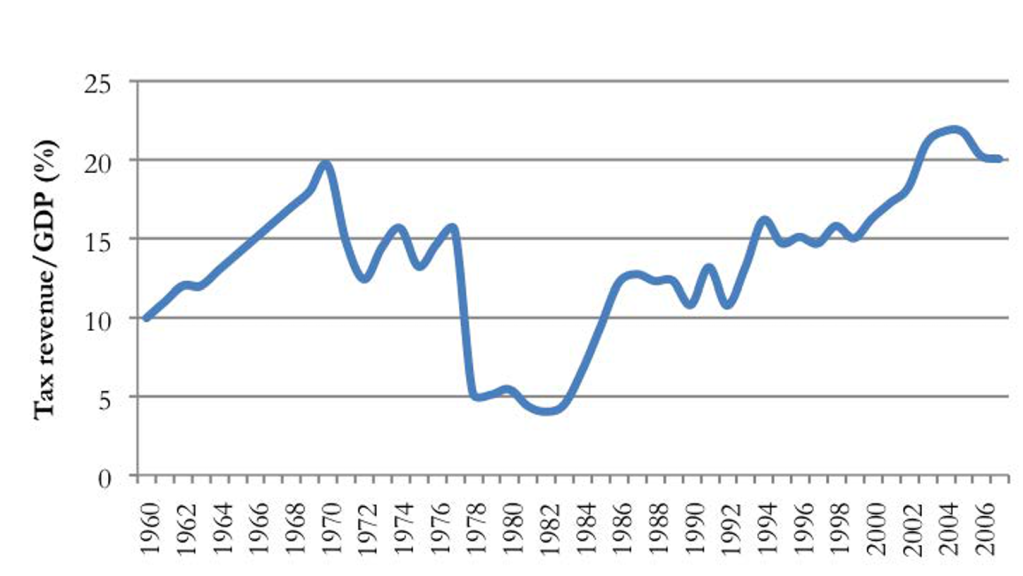

First, the historical evidence does not suggest that the government is able to squeeze more out of the economy when Ghanaians suddenly become upright and scrupulous in between epochs in history. It suggests, rather, that how much government takes in taxes reflects shifts in the relation between the state and business.

In the 1960s when the state run large parts of the economy, and the private sector was young, it was natural for the citizens to pay less tax. As Ghana liberalised, and private sector activity grew, more tax was paid. Then the Acheampong government came in and nationalised large swathes of the economy (for example, the government took 55% in major mines and factories hitherto majority owned by the private sector). State-control took the tax-to-GDP ratio to its lowest in 1981 – 1982, in the heat of the last attempt at a socialist revolution. Tax to GDP continued to climb as the emphasis shifted to private sector empowerment, until the discovery of Eurobonds in 2007, the onset of oil production in 2010, and the start of the gold and cocoa bull super-cycle (in both price and production terms) that is still underway.

Second, as I have hinted elsewhere, the considerable boom in oil, gold and cocoa prices and production over the last decade, backed by copious quantities of eurobonds, have considerably shifted the momentum in the economy towards the government-controlled center, to the detriment somewhat of the private sector. Without considerable private sector productivity growth, it is hard for taxes, versus other forms of revenue like royalties, to grow in line with or faster than GDP.

Third, the structural issues in the economy are also reflected by the sheer number of persons in various sectors where income is highly irregular or is taxed in ways making personal and corporate/enterprise taxation completely incongruous. For instance, 75% of Ghanaians farm, fish, “buy and sell” or engage in low-level artisanship. Farmers sell food with high implied non-state subsidies created by a massive differential between farmgate and urban retail prices. Cash crop farmers must actually sell at the government-dictated price so that the state can take a margin. These are all implicit taxes.

Furthermore, due to high domestic borrowing, central government financing (money printing, among others), and other “money emission” factors, coupled with a tendency to inflate away the value of the money it has borrowed from citizens, the government of Ghana enjoys high rates of seigniorage and inflation tax. As noted by many commentators in this sub-discipline, inflation tax has a habit of flipping at an inflection point and yielding negative returns. The chickens may have simply come home to roost in Ghana.

Not surprising then that two West African countries whose governments consistently lament their low tax to GDP ratios, Ghana and Nigeria, have also historically benefited the most from inflation tax.

In short, letting the data do the talking reveals the startling truth, in deep contrast with the standard commentary in Ghanaian policy circles, that Ghana actually outperforms many peers and superiors when it comes to registering people to tax them.

A person holding brief for the Finance Ministry is likely at this juncture to push back. Mobilising people into the tax net does not by itself mean that people are still not cheating the treasury. True, but that is not a peculiar Ghanaian issue. At any rate, politicians have consistently been twisting the truth by making it look like the “tax net” in Ghana is not “capturing” millions of shady characters with sackfuls of cash under their mattresses. What the above clearly shows is that over the last decade or so we have brought millions into that tax net. At least, they are visible.

We can now tackle the question of whether beyond the structural reasons (inflation, natural resource dependency, debt-fueled-but-low-productivity-growth etc.) I have provided above and elsewhere, there is strong reason to believe that under-declaration is particularly rampant in Ghana.

Let me get this out of the way: there is no reason to doubt that there is considerable under-declaration. As a brilliant friend of mine at a top consultancy likes to remind me, the Ghana Revenue Authority meets more of their stretched targets than they miss. Somehow, in some years, they manage to find the money lurking somewhere in the economy regardless how aggressive the target is set. The question we need to ask though is: how widespread is this practice, really?

If it turns out that we have a few ultra-wealthy cabals doing most of the under-declaration, as opposed to the general masses of the long-suffering people of Ghana, then the key thesis of this essay holds: there is no evidence that Ghanaians generally don’t like taxes (anymore than the average human), aren’t paying taxes or are particularly unscrupulous about taxes. It is entirely up to the political class to rein in their cronies in the cabals, currently enjoying political protection, hoarding the wealth and refusing to chip into the national kitty.

To make progress along that line of inquiry, it is important to unpack the recent decline of revenues-to-GDP from 22% in 2005 (per Matthew Ocran’s calculations) to roughly 14% today (beyond the structural factors I have hinted at above, that is). What really in the tax basket has been leaking out?

A 2021 report by the UK’s Institute of Fiscal Studies (IFS) reveals much. (As a side note, it is curious that the IFS in its home base of Britain is regularly counted on to produce independent revenue forecasts for proposed taxes, like our e-levy here; but in Ghana, the government routinely refuses to encourage such rigorous tax analysis and forecasts before introducing its tax measures.)

Let me quote the IFS:

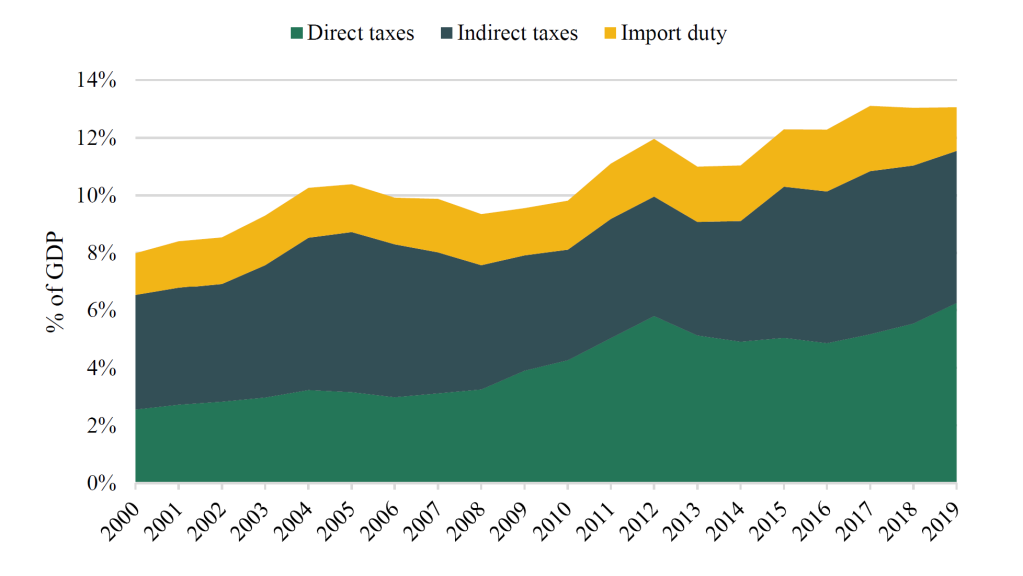

Tax collections on imported goods have become far less important in the revenue mix, though they remain significant: 30% of overall tax revenues were collected on imported goods in 2019 (including VAT on imported products), compared with 54% in 2000. The contribution of import duties specifically to total tax revenue declined from 18% in 2000 to a low of 12% in 2019.

And:

Much of the growth in Ghana’s GRA-collected tax revenues since 2000 has come from increased corporate and personal income tax and VAT and similar taxes, though revenue growth from the latter two has stagnated more recently. These taxes made up over 70% of total collections in 2019 – up from 57% in 2000.

In short, whilst Ghanaians have been paying lots more in income taxes on both their personal and business income, the ports have been leaking.

There are two main ways to account for those leakages. First, graft. The Vice President has described the corruption at the Port as “unbearable”. Second, tariff policy. The average tariff in Ghana is about 92.5% of the value of the item being imported. Essentially, on average, importers pay almost the equivalent of the price of the good being imported to the government as tax.

The high tariffs are a clear incentive to bribe one’s way through if one has the means, so the two main causes are interconnected. But given the implied import-substitution and infant-industry protection bent in current Ghanaian trade policy, a significant reduction in tariffs is unpalatable to almost everyone in the policy establishment today.

Below is a graph showing how Ghana compares with other countries its policymakers and other commentators like to compare the country to. Note the presence of both liberal and “developmental-statist” economies on the list. It is clear that imports have become so expensive over time that the growth in their volumes has been dropping, leading to a drop in revenue from import duties and other port-levied taxes. The trend is furthermore being exacerbated by bribery and corruption.

The truth is: when you look at the part of the revenue mix obtained purely through GRA collections (as opposed to the broader measures of “revenue” used elsewhere in this essay), what we have is a stagnation due to a declining trend in import tax collection, not fully offset by a growth in personal and corporate income tax collection!

The alarmism by politicians, targeted at the conduct of citizens, is completely unwarranted and the media must stop enabling it and start asking hard questions.

Of course, politicians will still push back. They will say things like: people are doing many side jobs and not declaring income so the rise in income tax revenue is purely as a result of the burden falling on a smaller and smaller subset of taxpayers.

Whilst there is no doubt about there being a skewed burden that must be corrected over time, this has become something of a universal burden brought about by a growing concentration of wealth.

In the US, for instance, the top 20% pay nearly 70% of the taxes.

In Singapore, the top 20% of tax payers account for 91% of total tax revenue. Only 7.8% of Malaysia’s 1.25 million registered enterprises pay any tax at all.

So, if a Finance Ministry Mandarin is tempted to argue that Ghana is yet to see any significant benefit from boosting registration of taxpayers, they should temper their sorrow by checking with India where aggressive taxpayer mobilisation saw filings grow to 57.8 million. Yet, those actually owing the Indian government dropped to 14.6 million (coupled with massive numbers of Indians now entitled to tax rebates/credits). To repeat: over a period of 8 years, the number of persons registered for tax but who don’t have enough income to pay any tax to the government increased by 300% in India.

It is not a one-way street. The more government pries into people’s incomes, the more likely some of them are going to realise that they don’t actually get enough help from the government and therefore it is the government that in fact owes them money.

In 2019, 37% of even American taxpayers assessed as owing tax didn’t have the money to pay. In recent years, Indonesia has seen spells where less than 1 million citizens are able to pay tax out of a population of over 270 million.

The last rebuttal to any Finance Ministry Mandarin pressing the old charge of ruling a nation of tax delinquents is wastage.

I am not even talking about the incongruity of tax aggressiveness in a context of high tax burden in a country where many are struggling to make ends meet and therefore only a shrinking number of people shall increasingly be responsible for most of the tax paid, as is the case elsewhere, and how therefore any wastage of taxes may impact tax morale. I am talking specifically about why the government feels that Ghanaians pay far less tax than they can afford when the data says otherwise. And when Ghanaians are indeed subject to some of the highest tariffs and consumption taxes in the world. Just check out comparative VAT rates below.

Or compare aviation taxes in Ghana with what pertains in its rival “aviation hub” aspirants in the region. Ghana charges double the rate in Rwanda and Kenya, and nearly four times the Ethiopian amount. Yet, it insists that it is on course to eclipse them as a continental aviation nexus. Talk of hubris.

No I don’t mean any of that at all. What I mean by “waste” here is the sheer cost of doing government in Ghana. Ghanaian state-subsidised football administrators regularly requests, and often receives very close, to three times the amount their Nigerian and Kenyan counterparts get, and ten times what their Malawian and Gambian compatriots receive.

When Ghana builds bridges or airports, a careful examination of the costs (including borrowing costs) would inevitably show that, pound for pound, they tend to be twice or thrice more expensive. This is the case when you compare Kotoka Terminal 3 in Accra with the bigger 3rd terminal at Bole International in Ethiopia; or the planned Volta River Bridge in Ghana with the Makupa bridge in Kenya.

In short, the government of Ghana has been harbouring this mistaken notion of Ghanaians being inveterate, incorrigible, tax thieves because it feels that it is being squeezed. However the “squeezing” is entirely the doing of the state, and the victim is actually the people.