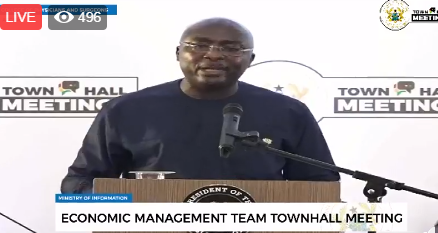

Vice President and the head of the Economic Management team Dr Mahamudu Bawumia has given reasons why the cedi depreciated from January to March this year.

Speaking at a town hall meeting in Accra to address issues regarding the economy, Dr Bawumia said the seven action plan given to the country by the IMF, which was to be completed by March this year, was the caused of the Cedi depreciation.

According to Dr Bawumia, while the cedi was depreciating the Bank of Ghana could not intervene because the Central Bank was required to increase its net international reserves to the level of December 2018, which means the Bank of Ghana could not sell any foreign exchange on the market.

The Cedi depreciated for the first three months of 2019, the situation made it difficult for businessmen to transact business smoothly.

READ ALSO:

BoG backs bi-partisan probe into Cedi depreciation

Bi-partisan committee to probe Cedi depreciation needless-Economist

Gov't blames Churches for Cedi depreciation

Explaining the real cause of the cedi depreciation, Dr Bawumia said:

"the most important and the proximate cause of the the recent depreciation is the time inconsistency of an IMF prior action on the reserves target, at the end of January as part of the 7th prior actions to get to the IMF board and completion of the IMF programme the IMF gave Ghana 7 actions to complete before March 2019, one of the conditions that the Bank of Ghana had to meet was to increase its net international reserves to the level of December 2018, to increase the net international reserve however meant that the Bank of Ghana could not sell any foreign exchange in the market, they have to hold their hands to the back and could not intervene on the market during this particular market so demands for foreign currency was not met by supply as it normally happens on a day to day basis, we when the demand is greater than the demand the price will go up and this is exactly what was happening."

The Finance Minister Ken Ofori Atta explaining efforts to stabilise the cedi said the situation will soon improve.

“We have about $300 million coming in from COCOBOD and another $600 million also from COCOBOD in about a month or so. We have officially launched our Eurobond which will be $3 billion and that should close within the next couple of weeks.â€

Cedi Depreciation

The Ghanaian Cedi has been depreciating against major trading currencies for the past few weeks. On Wednesday, February 20, 2019, the Cedi is trading at 5.25 against the US Dollar.

Due to this, some industry players have called on the Central Bank to put in more dollars to ease the pressure of doing business in the country.

But explaining the current depreciation of the Cedi Director of Treasury at the Bank of Ghana, Stephen Opata said some key factors are making it difficult for the cedi to be stable in the past weeks.

Comparing the trend of depreciation from 2018 to January 2019 he said: "as at the end January, approximately the cedi has depreciated by 3.6 per cent if you compare it to the same period in 2018 it's a slight depreciation of 0.1 per cent, and this means the trend can be reserves subject to significant foreign inflow and other factors.

Outlining the factors, Stephen Opata said the depreciation of the cedi last year was mainly driven by external development as well as some domestic pressure from the corporate and energy sectors and more recently re-alignment of the rate in the market.

"First is our foreign exchange cover from non-resident investors, repatriation of coupon payments and bond maturities, we have a significant international investor base who invest in our bonds and when coupons are due and the banking system is not able to meet the foreign demand to repatriate the coupons and maturity, then sometimes they will have to fall on the central bank and we use our reserve to meet that, an important source of pressure is also from the energy sector especially independent power producers obligations and oil import."

www.primenewsghana.com/Ghana News

Â