The government has extended the Settlement Date of the Exchange from the previously announced February 14 to 21 February in the Domestic Debt Exchange Programme (DDEP).

This is to provide sufficient time to settle the New Bonds in an efficient manner, a statement issued by the Ministry of Finance said on Tuesday February 14.

“To provide sufficient time to settle the New Bonds in an efficient manner, the Government is extending the Settlement Date of the Exchange from the previously announced 14th February 2023 to 21st February 2023”, the statement indicated.

The issue date, interest accrual schedules and payment schedules for the new bonds will be adjusted to reflect the actual settlement date.

READ ALSO: DDEP: All coupon payments, maturing principals will be paid – Gov’t assures bondholders

No new tenders will be accepted, and no revocations or withdrawals are permitted following the expiration of the exchange period.

In the statement, the government announced the results of the Domestic Debt Exchange Programme (DDEP) which closed on February 10, 2023.

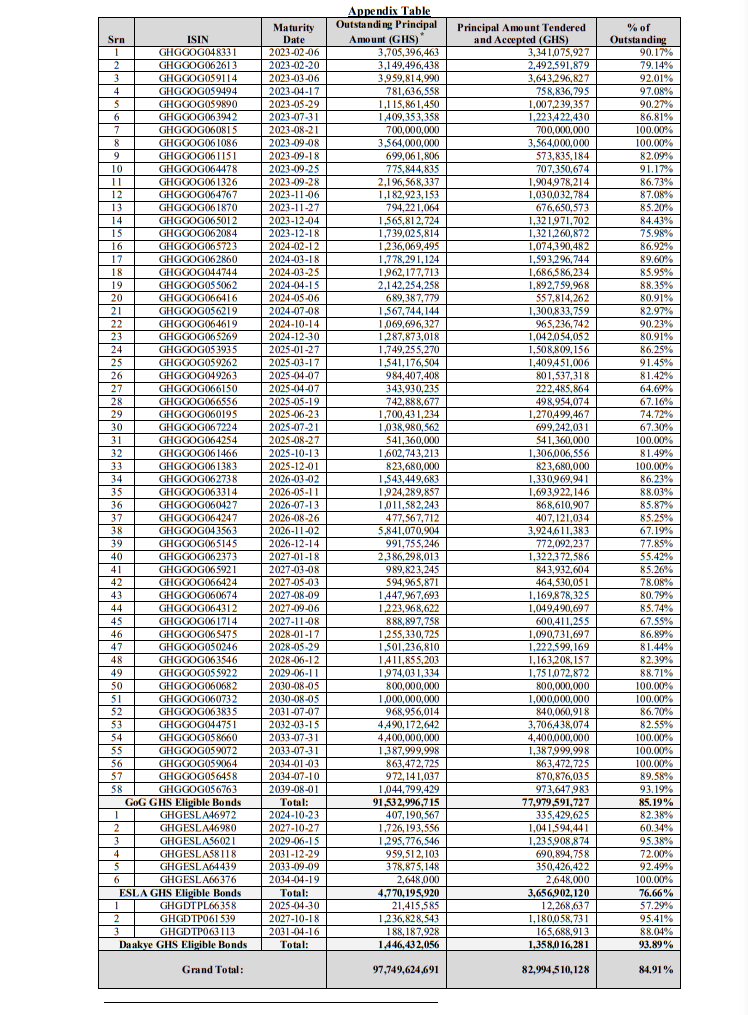

The Ministry of Finance revealed it has successfully swapped GH₵82,994,510,128 worth of old bonds from a possible GH₵ 97,749,624,691 under the programme.

The amount represents an 84.91% success rate exceeding the Finance Ministry’s intended target of an 80 percent participation rate.

“The government is pleased with the results, as a substantial majority of the eligible holders have tendered”, it said.

In addition, the government is modifying the six-month “clear market” provision of the new bonds as set forth in the Exchange Memorandum to clarify that such clear market provision will not limit the Government from issuing Domestic Public Indebtedness in connection with liability management exercises involving exchanges or similar exercises that do not involve the issuance of Domestic Public Indebtedness for cash consideration.