The Ghana Amalgamated Trust (GAT) says it would start recapitalizing the five local banks from March 2019 after it raises all the GH¢2 billion from investors for its five-year corporate bond.

According to an agreement reached with the Bank of Ghana, the five local banks should fully meet the minimum capital requirement by March 31 2019.

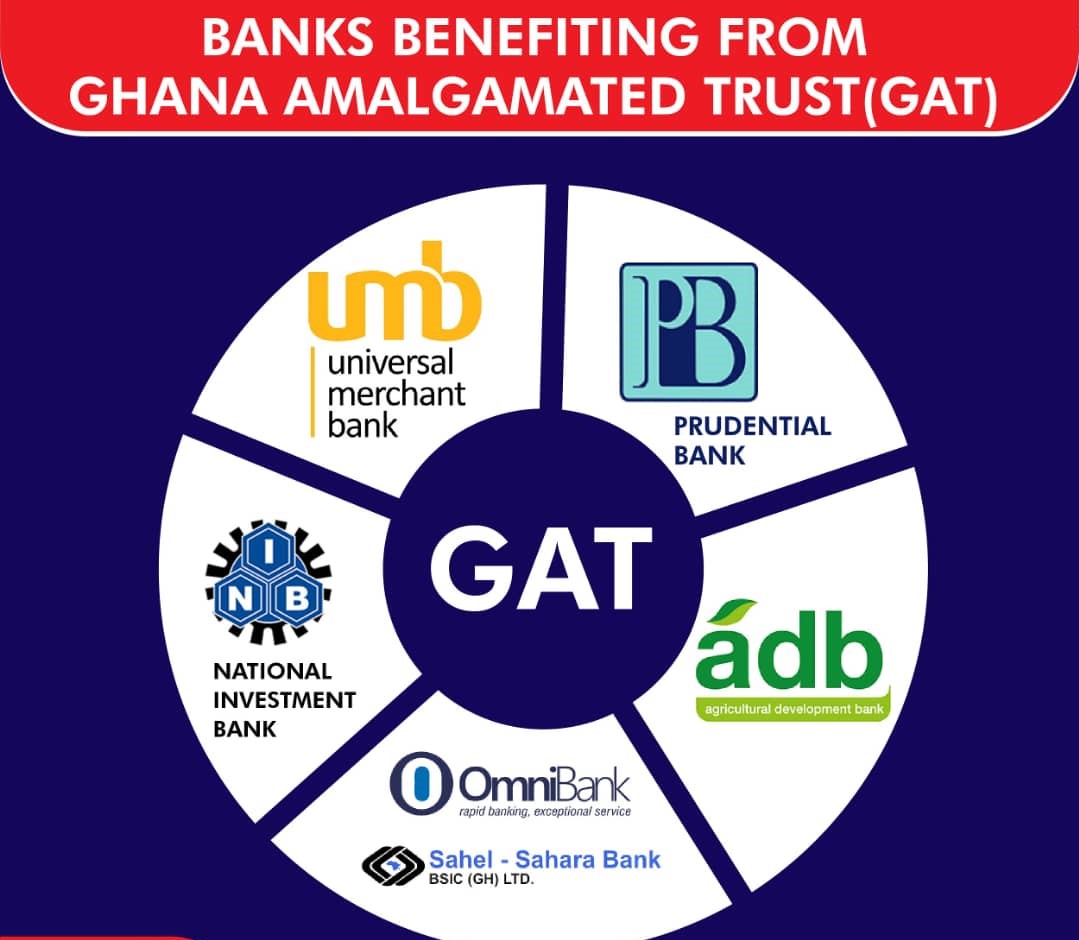

The government last year set up the Ghana Amalgamated Trust, a special purpose vehicle, to recapitalize some local banks that need some top up. This is to help these local banks to meet the Bank of Ghana new minimum capital requirement of GH¢400 million.

The five banks that were shortlisted for support included ADB, Prudential Bank, UMB, Sahel/Omni Bank and NIB. GAT has been structured as a private equity model to recapitalize these local banks.

Read also: Rural Banks call for a reduction in corporate tax

Details and structure of the GH¢2 billion corporate bond

Speaking to JoyBusiness, Managing Director of GAT, Eric Otoo, said the Trust is working to start the fundraising exercise from next week after the prospectus for the corporate bond issued by GAT is formally released.

He said, “we are planning to raise GH¢2 billion through a five-year corporate bond, but the money would be raised in two tranches.â€

Mr Otoo added that GAT would be paying an interest of 21 per cent per annum because it’s a “zero-rated bond†but rather the principal plus the interest would be paid at the end of five years. The bond would be raised in two tranches; the first would be GH¢750 million and another GH¢1.5 billion.

The GH¢750 million would be shared among ADB, UMB, Prudential and Sahel and Omni Bank; however, NIB is expected to receive GH¢1.5 billion.

The bond would be listed on the Fixed Income market on the Ghana Stock Exchange after the fundraising before the end of this month.

Targeted Investors for the 5-year corporate bond

Pension fund managers and the general investing public would be targeted in this planned bond issue.

Mr Otoo told JoyBusiness they have already had some pre-engagement with these investors to ensure the fundraising exercise becomes successful. On the Pension Fund managers, Mr Otoo maintained that nobody is being forced to invest, adding “every fund manager had the opportunity to assess the viability of the bond and they are doing it at their own will.â€

GAT plans to have a controlling interest in the local banks

The Ghana Amalgamated Trust is also working to take a controlling stake in some of these local banks. This is part of measures to ensure that the necessary measures are instituted to closely monitor their investments.

The plan could result in the taking of some positions on the board of these banks and possible management roles.

Accounting firm Price Water House Coopers (PwC) is currently reviewing the books of these five banks, that is: ADB, UMB, Prudential and Sahel/Omni Bank and NIB to guide placement of the GH¢2 billion that would be raised possibly from next week.

Government to guarantee the 5-year corporate bond

Government is expected to offer 70 per cent guarantee to the 5-year bond. This would ensure that in case GAT has any challenge in securing the required returns for investors, the government would step in to pay the investors.

However, the Managing Director of GAT maintains this should just be seen as a guarantee and that they promise to work hard to deliver prudent returns to investors

Credit: myjoyonline

Â

Â