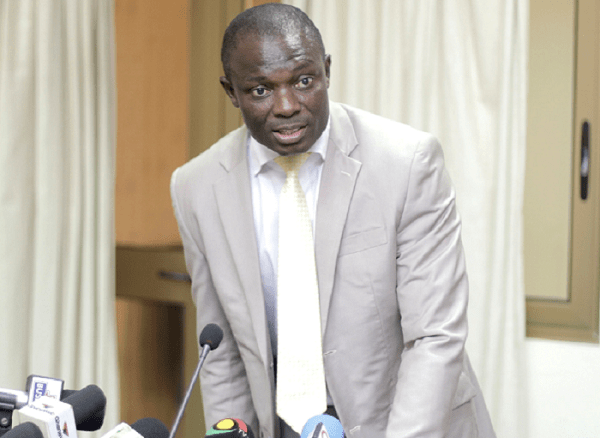

The Deputy Finance Minister Kwaku Kwarteng has advised local banks in Ghana to merge in order to meet the Bank of Ghana’s minimum capital requirement of GH¢400 million.

According to him, this will avoid the banks from folding up thus, ensuring stability of the financial sector.

“recently, we have seen Capital bank go down, we have seen UT bank go down, and we have seen the difficulties that Unibank has run into. [And] the point is that in all these but for the fact that government intervened, the money of depositors would have been lost.

“So, the responsibility is on the Bank of Ghana to ensure that…financial intermediation is done by institutions and companies that have the capacities to do it without compromising the stability of the financial sector, without endangering the deposits of depositors, so that overall people will have confidence that if I put my money in the bank that money will there for me at all times.â€

Meanwhile, former Deputy Finance Minister Cassiel Ato Forson has said in an interview with Starr FM that the call to introduce a minimum Capital Requirement of GH¢400million is unnecessary, it is unreasonable and it is arbitrary and needless.

However, reacting to the Minority spokesperson on Economy Cassiel Ato Forson the Deputy Finance Minister Kwaku Kwarteng said “the Bank of Ghana has found it necessary to put these Capital Requirement so that once companies and businesses are able to satisfy these requirements, you are fairly assured that the interest of depositors and the interest of Ghanaians are protected.â€

He, therefore, advised that, If the minimum capital requirement is raised the option for banks that are small is to merge.

The Bank of Ghana in 2017 raised the minimum capital requirement to GH¢400 million, where commercial banks in Ghana were given up to December 2018 to raise the amount, which represents a 333.3 per cent increase from the current minimum capital of GH¢120 million.

primenewsghana.com/business.html

Â