Ghana’s gross International Reserves at the end of February 2021 was US$8,719.7 million, providing cover for 4.2 months of imports of goods and services.

The reserve level compares with the end-December 2020 position of US$8,624.4 million, equivalent to 4.1 months of import cover.

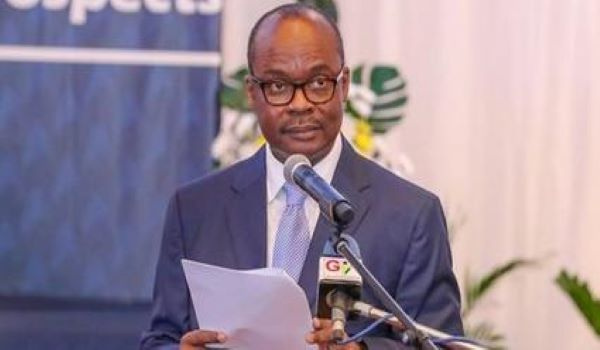

Dr. Ernest Addison, Governor of the central bank, who made this known, also said, cumulatively the Cedi appreciated by 0.6 per cent against the US dollar in February 2021, compared with an appreciation of 4.5 per cent in the same month of 2020.

The Cedi also appreciated by 3.6 per cent against the Euro and depreciated by 0.9 per cent against the Pound Sterling, compared with corresponding 7.0 per cent and 7.8 per cent appreciation over the same period in 2020.

He said private sector credit growth slowed in the first two months of the year due to constrained demand for credit. Annual nominal growth in private sector credit slowed to 7.4 per cent in February 2021, compared with 21.8 per cent in the corresponding period of 2020.

Similarly, real private sector credit contracted by 2.7 per cent compared to a growth of 12.9 per cent over the same comparative period.

Interest rates on the money market broadly showed downward trends for short-dated instruments and mixed trends for medium to long-dated instruments. The 91-day and 182-day treasury bill rates declined to 13.6 per cent and 14.0 per cent respectively in February 2021, from 14.7 per cent and 15.2 per cent respectively in February 2020.

Similarly, the rate on the 364-day instrument decreased to 16.9 per cent from 17.8 per cent over the same comparative period.

Rates on the secondary bond market have also generally declined, except for rates on the five-year bond which increased by 35 bps to 19.9 per cent. Yields on two-year, three-year, six-year, and seven-year bonds declined, while rates on the 10-year, 15-year, and 20-year bonds remained unchanged.

Goldstreet Business