The Chief Executive Officer of Ghana Interbank Payment and Settlement Systems (GhIPSS), Archie Hesse, has accepted the challenge thrown by the Vice President, Mahamudu Bawumia, that stakeholders should ensure the interoperability of telcos by the end of the year.

Speaking at the 5th Economic Outlook and Business Strategy Conference held in Accra, the Vice President urged GhIPSS, banks and telecommunication companies to ensure that there is interoperability between Ghana Link, which is a GhIPSS platform, the e-zwich platform and the mobile telephone platforms within six months.

He said this was important in advancing the electronic payment agenda. He noted that the country had the requisite infrastructure to achieve this goal.

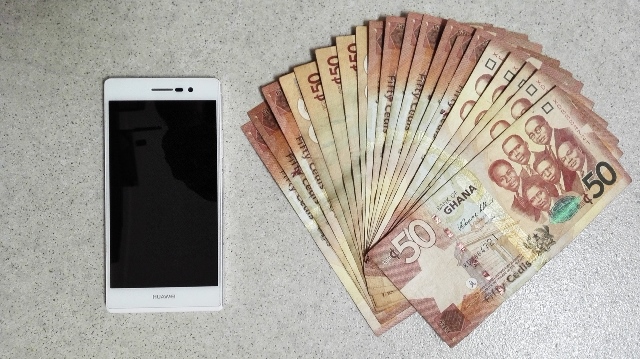

When telcos become interoperable, customers will be able to send and receive mobile money across the different mobile phone networks, which is currently not possible.

When he took his turn at the conference to moderate discussions on the development of technology backbone to support digital payments, Mr. Hesse agreed that interoperability among telcos was extremely important.

He said the absence of this interconnectivity was inimical to the goal of financial inclusion through mobile money. He said GhIPSS was going to meet with key stakeholders to work together to meet the six-month deadline.

GhIPSS currently has the infrastructure that supports interoperability among banks and this technology could be extended to also cover the telcos.

Technology companies operating in the financial sphere (known as 'Fintech companies') say there will be significant growth in digital payments if inter telcos mobile money transactions were possible.

The Chief Executive of the Ghana Chamber of Telecommunications Kwaku Sakyi-Addo, who has been passionate about the growth of digital payment, said the interoperability would achieve even more if government pushed its agencies to accept payments via mobile money and other digital forms of payments.

Â

Credit B&FT