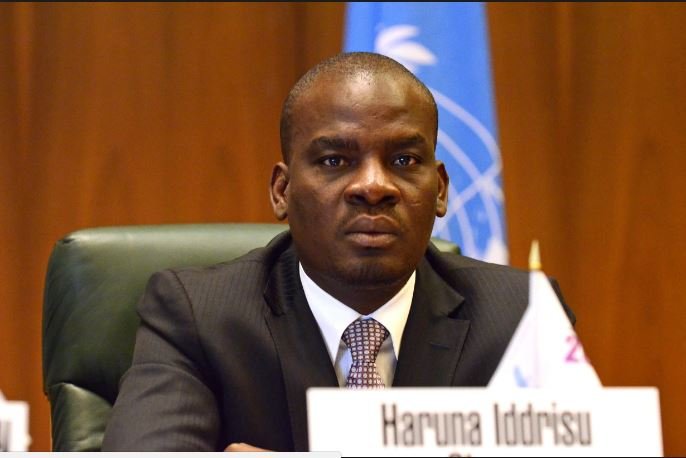

The Leader of the Opposition ("Minority Leader") in Ghana’s “hung” Parliament, who has been a perfect picture of parliamentary due diligence so far in the matter of the stranded 2022 government budget, startled the public by announcing prematurely that he will accept a 1% e-levy rate.

The government has proposed the imposition of the tax on all electronic financial transactions, a mainstay of its plan to increase revenue by 43% in 2022. A 43% revenue increase in one fell swoop would be mindboggling in normal times, but things are far from normal in Ghana’s fiscal circumstances now that servicing public debt is threatening to consume 60% of all government revenues (in the first 9 months of 2021, government revenue was $7.86 billion and it spent $4.23 billion, or 54%, of it servicing loans).

What analysis was the Minority Leader’s capitulation based on? Why 1% and not, say, 1.25% or 0.75%? He doesn’t say.

It is Not just about the 1.75% rate or 100 GHS floor

At any rate, it is not the absolute rate of the e-levy that matters most but rather its entire design as a digital taxation measure that will impact the growth of virtually all digital services well outside the financial sector.

Because of this factor, leaders of policy-oriented Civil Society Organisations (CSOs) are very close to asking the Government to remove the e-levy measure from the budget altogether in order not to derail the entire appropriations process. With e-levy out and a more comprehensive consultation process underway to flesh out a more detailed digital taxation strategy, the less contentious remainder of the budget review by Parliament can continue relatively smoothly at the committee level. Of course, there are equally or even more problematic provisions in the budget, such as a promise, or more appropriately, threat, to return the unconscionable Agyapa policy to Parliament for approval. But that is another matter.

Policy oriented CSOs are yet to come to any broad consensus on the e-Levy, but my survey of the mood of leaders in the community shows growing discomfort about the poor attention paid by the Government to the fact that there are many different design options available in crafting the e-levy, each with different implications.

The absolute rate of 1.75% and the minimum daily cumulative transactional threshold of 100 GHS before the tax kicks in, as indicated in the budget, are by themselves meaningless concepts. The revenue estimate of $1.15 billion is also almost certainly wrong. These three data points are, to repeat, pointless without a ton of caveats about how precisely the e-levy will be designed.

The Budget Process in Ghana is not designed for making fresh & complex policies

Yet, the budget is not the place to roll out complete policy. Policy is first debated by key stakeholders, such as the official opposition and CSOs, finalised, and then the revenue and expenditure implications are captured in the budget. The approach taken by the Government so far puts the cart before the horse.

The minority leader and other important commentators like him who have jumped the gun to reduce this complex debate to a rushed haggling over absolute rates (1.75%) and minimum thresholds of taxable transaction value (100 GHS) are risking a Missouri Compromise which will come back to bite all of us later.

In this brief analysis I hope to show, in broad outline, why the Minority Leader needs to align with the cautious camp and ask for the e-levy to be subject to a wider and deeper policy evaluation process instead of the perfunctory quibbling over narrow figures characteristic of the Ghanaian appropriations process.

Our call is even more poignant now that we know that the Government has set aside a full $40 million (35% more than the total allocation to the National Health Fund) to pay vendors for very suspicious services related to rollout and collections of the e-Levy.

If it turns out, as I will argue shortly, that the $1.15 billion expected to be raised from this tax could turn out to be far less, and yet the effects of the tax may well be what economists call “distortionary”, then its risks would far outweigh its benefits, and it will be sensible to return it to the drawing board.

$1.15 billion revenue estimate in the 2022 budget is naive

Even without a detailed policy document, which the government characteristically refuses to provide, most analysts have pointed out that the $1.15 billion seems to have been derived from a naïve application of the 1.75% tax rate to the portion of the total transactional value of Ghanaian electronic financial services - roughly $130 billion - made up of transactions above $17 in value.

Everyone of course knows that this massive value of total transactions, nearly double Ghana’s GDP, does not represent actual economic value addition or even value generation. It is more akin to how global forex trading has a turnover of more than $200 trillion every month, yet global GDP is only $85 trillion.

To understand the real underlying economic value in electronic financial services, consider that despite the over $100 billion in transactional value, the nominal balance on mobile money float (how much the telecom networks actually retain with the banks to cover the liability claims of e-money) is about $1.3 billion. MTN, the overwhelmingly dominant market leader with over 92% market share, maintains a $1.15 billion float and annually makes about $216 million in profits from the $90 billion or more that circulates across its networks (0.0024% “margin”).

Not all electronic payment channels and e-Money transactions are the same

Interestingly, however, not all electronic financial channels behave similarly, and users of those channels both imprint their behavioural patterns and are in turn imprinted back. That fact is seriously crucial in determining both what the real take from the e-Levy would be as a direct consequence of HOW it is designed and how the tax could impact various parts of the economy.

For example, whilst mobile money transactions now exceed 3 billion per annum in volume, the quantity of debit card transactions totalling $4.3 billion in 2018 was only 61 million, yielding an average transaction volume of $71 per transaction or nearly 400 GHS per purchase, with medians and means well above the proposed transaction threshold of 100 GHS, unlike the situation with mobile money. The overwhelming majority of these card transactions were on international rails like Visa and Mastercard, which have other significant charges, because customers continue to shun the supposedly cheaper Gh-Link product being imposed by GhiPPS (transactions on Gh-Link have dropped to barely $55 million from a high of $140 million in 2017).

As an aside, the trend of failing government-imposed digital financial products reflects in the abysmal float on E-Zwich, which is a measly estimated amount of ~$25 million (described as “value on card”), up marginally from $22 million in 2018 (total value of E-Zwich transactions exceeds a billion dollars per year, by the way). The reason is partly due to high leakage out of E-Zwich, mainly into cash-out, but also the result of government ignoring consumer behavior in its design of policy.

E-Money is overwhelmingly used for offline payments not digital services

Indeed, the vast majority of electronic payments relate to paying offline merchants or peers, or taking cash out. These expenditure patterns have stayed relatively stable. ATM transactional value, a major proxy for cashout preference, for instance, has grown from ~$4 billion in 2017 to ~$5.2 billion today. Whilst POS terminal spending, a good proxy for offline merchant engagement, reached ~$1.6 billion in 2018. Together they account for most card transactions volume, with online merchant spending trailing far behind.

Internet banking transaction value, which better reflects the growth of online digital services, on the other hand, has actually dropped from a high of more than $2.1 billion in 2017 to an estimated $1.5 billion today, and registered users are down by about 5% from highs of nearly one million in 2017.

Meanwhile, the large ticket size (~$260,000) of interbank settlements (RTGS/GIS) also reflects the weak presence of small and medium enterprises and a corresponding absence of boutique banks, particularly after the so-called "clean up" exercises in the banking sector.

All the above goes to show that whilst payment channels that enhance offline cash-substitute behavior are thriving, those that will foster the growth of spending online on actual digital services (such as e-commerce, edtech, e-health, e-insurance, agtech etc) are trailing far behind and in some cases declining. Most Ghanaians still see e-money as purely an offline cash substitute and not as a means to participate more deeply in the digital economy.

E-Money is not stimulating GDP growth and transformation well enough

An intriguing validator of this view is the concept of an “e-money base” as a loose mirror of the more conventional notion of “narrow monetary base”, i.e. liquid cash and on-demand banking. In Ghana, this monetary account line item (sometimes called M0) is about $6 billion. But if one strips the figure of its on-demand banking elements, and focuses purely on physical cash (or currency) in public circulation, one gets about $3.8 billion.

When looking for an electronic parallel to this physical cash amount for analysis, a host of complicated treatments is required, which I won’t go into here. Suffice it to say that the crude figure of $10 billion (aggregate e-money float in the economy stripped of multiplier effects) in the table above should be fine for the simple arguments in this note.

The elementary equation linking GDP and inflation to money supply will yield, in this crude analysis, a physical cash velocity of 19.5 and a e-money velocity of just 7.5. That result is fully consistent with the position canvassed above that, presently, electronic financial services and e-money in Ghana are not sufficiently stimulating the creation of new services. Nor are they proving an effective boost for digital production to stimulate GDP growth. E-money is still fundamentally a cash-substitute for offline transactions. For the size of Ghana’s digital economy to reach the level of, say, Indonesia (at ~2.5% of GDP), it would need to nearly quadruple.

E-Levy will elicit behaviors that can harm digitalisation

If the analysis above holds, then we must consider, as the late Martin Feldstein used to preach, not just the revenue estimate that will result in a steady-state GDP model but also the revenue implications of consumer behavioral responses to the tax and their impact on digital GDP. Here, an elementary economic analysis tool comes to our aid: cross-elasticities.

Given the fact that the most digitized payer in Ghana today is the government, with 85% or more of government payments now digitized in the wake of successive reforms culminating in GIFMIS, compared to less than 40% of private sector payments, the political economy reality is that government will exempt government payments from the tax. It will do this not only to avoid useless double-counting from government taxing its own revenue, but in other interesting ways.

Quasi-government payments such as cocoa cash transfers by licensed buyers, SSNIT related payments and a host of others will over time also qualify for exemption due to lobbying. Because government’s contribution to the e-Money base is significant, this political economy based behavioral response must be compensated for by a shift of the burden to the private sector by government trying to game private sector exemptions.

Meanwhile, the fact that different payment channels, as discussed above, are optimized for different average transaction values, cumulative frequency of payments, and exemption benefits, shall elicit even more complicated gaming responses from private payers.

For example, lobbying is likely to lead to Government setting an upper bound for the e-levy’s application to transactions. It is unthinkable to think that the Government will be able to resist lobbying from investors repatriating their cash abroad for instance to pay the full rate on the full amount. Whatever ceiling the government sets beyond which the total tax payment stays fixed, payers will have an incentive to aggregate and compress their payments across time to benefit from the cap.

Meanwhile, away from the wholesale level and in the more higher-churn retail-point businesses (like table-top hawkers), for which the 100 GHS floor is no comfort, the ability to pool deposits is more constrained, with tragic equity effects. Some smaller payers nonetheless would be able to splice and distribute their payments across time to try and avoid crossing the 100 GHS threshold or whichever floor is set.

Then there is of course the fact that if, as the analysis above suggests, e-money is primarily a cash substitute at offline merchants, then the tendency to carry cash in order to avoid the tax will increase. Cash use in the economy has proven highly resilient. Supply has risen in aggregate terms by about 70% since 2017, and approximately 65% of all transactions still use cash. Compare this to Sweden, for instance, where only about 5% of the population still shop with cash.

The likelihood that a poorly designed e-levy will lead to Ghanaians continuing to stay away from digital services and entrenching in their use of cash, whilst restricting e-Money to cash-substitute at offline merchants only when transactions fall below the threshold or are considerably above the cap will be high. Where a tax induces such complex behavioral responses, it can have wholesale distortionary effects on a major part of the economy, in this case on digital GDP.

In sum, the wide and complex range of exemptions, not least because of government’s strong role as a payer; the interplay between caps and ceilings; and the cross-transaction elasticities (or inducements to switch from payment types) all suggest that different e-levy designs could have dramatically different impacts on the economy. We know for sure that the $1.15 billion revenue estimate in the budget is seriously flawed, as the total eligible value to be taxed is less than the naïve base of total electronic transaction value the government is using. But we can’t be too certain about all the effects until we consider multiple design options. Just knowing the daily cumulative transaction taxability threshold (100 GHS or any other number) and the absolute rate (1.75% or any other number) tells you very little about the likely impact of e-Levy.

E-Levy is NOT just a quick tax measure; it can have lasting impact & need more analysis

In fact, even from a pure monetary policy impact point of view, different e-money transactions behave differently, both in terms of their impact on monetary aggregates and the money multiplier. Empirical evidence from places like Bangladesh show that should the e-Levy encourage cashouts from wallets and discourage B2P, B2C and C2C/P2P transactions, inflationary effects can ensue. Current Bank of Ghana exogenous shock models rely primarily on vector autoregression formulas that are seriously unequipped to deal with the complex behavioral dynamics of gaming by large numbers of agents.

Lastly, before the country rushes into setting absolute rates and floors, as the likes of the Minority Leader would have it, a deeper policy evaluation exercise would also definitely benefit from cross-country comparative analysis. Renowned Kenyan Economist Njuguna Ndung’u has shared empirical evidence from Kenya that shows emphatically that even plain vanilla excise taxes on financial services can dampen growth. What Ghana is proposing to do, depending on exact design, may well be unprecedented worldwide and will therefore require careful modelling by looking at its divergences from global experience.

So, once again, the Minority Leader and all the major commentators pushing for a quick and ready compromise based purely on Parliamentary assent to the absolute rate and floor, but without further legislative guidelines on other features such as caps, exemptions and variations and slopes, are seriously jumping the gun.

This e-Levy thing needs its own separate policy treatment, outside of the tight budget process and timeline. Mr. Government, please take it out, work on it carefully, solicit stakeholder input, and return it to Parliament in the New Year.